Làm sao để nhận diện một doanh nghiệp tốt giữa hàng trăm cái tên trên thị trường? Đó là câu hỏi mà không chỉ các nhà đầu tư, mà cả các chủ doanh nghiệp, tổ chức tài chính lẫn người tiêu dùng thông minh đều đang không ngừng truy tìm câu trả lời. Trong video YouTube “Bí quyết chọn doanh nghiệp tốt qua xếp hạng tín nhiệm”, anh nguyễn Quang Thuân – một trong những gương mặt kỳ cựu trong lĩnh vực phân tích tài chính và xếp hạng tín nhiệm tại Việt Nam – cung cấp một góc nhìn sâu sắc và độc lập để giải mã câu hỏi đó.

Tôi là Hiển. Với sự quan tâm đặc biệt tới các nguyên lý vận hành của thị trường, tôi nhìn nhận xếp hạng tín nhiệm không chỉ là một công cụ kỹ thuật, mà còn là tấm gương phản chiếu văn hóa minh bạch và tính cam kết dài hạn của một doanh nghiệp. Trong kỷ nguyên mà niềm tin ngày càng trở nên đắt giá, quyết định đầu tư, hợp tác hay tiêu dùng không thể chỉ dựa vào cảm tính hay vẻ ngoài thương hiệu.Ta cần những thước đo minh định – và hệ thống xếp hạng tín nhiệm chính là một trong số đó.

theo một khảo sát của Tổ chức Hợp tác và Phát triển Kinh tế (OECD), các nhà đầu tư tổ chức tại châu Á xếp hạng tín nhiệm là một trong ba tiêu chí quan trọng nhất khi cân nhắc đầu tư vào doanh nghiệp khu vực mới nổi, trong đó có Việt Nam. Tuy nhiên, tại Việt Nam, khái niệm này vẫn còn khá mới mẻ, chưa phổ biến và chưa thực sự được hiểu đúng.

Điều làm nên giá trị của video này – và lý do khiến tôi chọn bàn sâu về nó – không chỉ nằm ở nội dung chuyên sâu hay ở những giải thích dễ hiểu từ chuyên gia, mà là ở cách nó chạm đến một chủ đề ngỡ như khô khan, nhưng trở nên thú vị khi được đặt trong bối cảnh thực tiễn của quá trình nâng hạng thị trường chứng khoán Việt Nam, cùng với nhu cầu cấp thiết phải chuyên nghiệp hóa hệ sinh thái tài chính.

Liệu xếp hạng tín nhiệm có đủ khách quan, liệu nó có thực sự giúp chúng ta nhìn thấy được “chất lượng cốt lõi” của doanh nghiệp, hay chỉ là một chỉ số hình thức khác? Đó là những câu hỏi tôi sẽ cùng bạn khai thác qua bài viết này – với mục tiêu không phải tìm kiếm câu trả lời đúng tuyệt đối, mà là để thấy rõ hơn phương hướng đi tìm sự minh bạch, bền vững và khôn ngoan trong lựa chọn doanh nghiệp đáng tin.

Hiểu đúng về xếp hạng tín nhiệm và vai trò trong việc đánh giá doanh nghiệp

Chức năng cốt lõi của xếp hạng tín nhiệm trong phân tích doanh nghiệp

Xếp hạng tín nhiệm không chỉ đơn thuần là một chỉ số về khả năng trả nợ, mà còn phản ánh mức độ minh bạch và sức khỏe tài chính tổng thể của doanh nghiệp theo cách nhìn độc lập và chuyên sâu. theo tôi,Hiển,đây là một công cụ đã bị hiểu sai hoặc xem nhẹ ở Việt Nam,trong khi tại các thị trường phát triển như Mỹ hay Hàn Quốc,nó là kim chỉ nam cho cả nhà đầu tư và doanh nghiệp. Trong chương trình có sự tham gia của anh Nguyễn Quang Thuân – chủ tịch PhúP và Fin Rating – anh đã chia sẻ rằng một xếp hạng tín nhiệm tốt không chỉ giúp doanh nghiệp tiếp cận vốn chi phí thấp, mà còn cải thiện hình ảnh và uy tín với cổ đông.Một nghiên cứu của Moody’s công bố năm 2021 cho thấy các công ty có xếp hạng tín nhiệm cao có khả năng duy trì chi phí vốn thấp hơn 18% so với các đối thủ cùng ngành không được xếp hạng. Đây là lợi thế mang tính chiến lược trong môi trường kinh doanh cạnh tranh.

| Criteria | Tác động tới doanh nghiệp |

|---|---|

| Chất lượng báo cáo tài chính | Minh bạch & tăng tín nhiệm |

| Mức độ vay nợ | Đánh giá rủi ro tài chính |

| Dòng tiền từ hoạt động kinh doanh | Khả năng trả nợ và tăng trưởng |

Lý do nhà đầu tư và doanh nghiệp không thể bỏ qua đánh giá tín nhiệm

Với kinh nghiệm nhiều năm làm việc trong lĩnh vực phân tích đầu tư, tôi nhận ra rằng một doanh nghiệp “tốt” không chỉ thể hiện qua lợi nhuận, mà còn qua cách họ được nhìn nhận bởi các tổ chức đánh giá tín nhiệm độc lập. Trong buổi webinar, anh Thuân nhấn mạnh: “Thị trường đang bước vào một kỷ nguyên mới, nơi mọi chủ thể – từ doanh nghiệp đến nhà đầu tư – đều phải chuẩn hóa và chuyên nghiệp hóa.” Điều đó nghĩa là, xếp hạng tín nhiệm không còn là “đặc quyền” của các tập đoàn lớn, mà ngày càng phổ biến hơn cho doanh nghiệp SME muốn gọi vốn.

Tôi thường đưa ra lời khuyên cho các bạn nhà đầu tư hoặc founder startup rằng hãy chủ động tìm hiểu cách các tổ chức như Fin Rating hoạt động. Bạn có thể bắt đầu từ việc trả lời câu hỏi:

- Doanh nghiệp của bạn có đủ chuẩn để được đánh giá tín nhiệm chưa?

- Bạn đã chuẩn bị dữ liệu tài chính theo chuẩn quốc tế chưa?

- Làm sao để xếp hạng tốt hơn năm trước?

Một case study gần đây tôi rất ấn tượng là Công ty A khi được fin Rating nâng hạng từ BB lên BBB+, chỉ trong vòng 6 tháng, họ đã tăng tỷ lệ gọi vốn thành công qua trái phiếu từ 60% lên 92%. Những con số này không biết nói dối, và là bằng chứng sống cho thấy xếp hạng tín nhiệm chính là “người gác cổng” cho niềm tin tài chính giữa doanh nghiệp và thị trường.

Từ góc độ nhà đầu tư cá nhân đến tổ chức xếp hạng chuyên nghiệp

Góc nhìn đa chiều từ nhà đầu tư đến hệ thống định chuẩn tài chính

Sau khi theo dõi video “DPS MEDIA“, điều khiến tôi – Hiển – ấn tượng mạnh mẽ nhất chính là sự giao thoa độc đáo giữa tư duy đầu tư cá nhân và hệ thống đánh giá doanh nghiệp chuyên nghiệp dưới góc nhìn của anh Nguyễn Quang Thuân. Là người từng làm kiểm toán, quản lý quỹ và giờ điều hành một tổ chức xếp hạng độc lập, anh mang đến một sự kết nối hiếm có giữa cảm tính và chuẩn mực. Với tôi,một nhà đầu tư cá nhân,việc tìm ra một doanh nghiệp tốt có thể đến từ cảm nhận về sản phẩm,đội ngũ lãnh đạo hoặc tốc độ tăng trưởng doanh thu. Nhưng với những tổ chức như Fin Rating, các tiêu chí đó được cụ thể hóa bằng hệ số, chỉ tiêu và rủi ro định lượng. Điều đó khiến tôi nhận ra một điều quan trọng: sức mạnh thực sự nằm ở khả năng quy chuẩn hóa góc nhìn – điều mà các nhà đầu tư đại chúng cần tích hợp nếu muốn ‘chơi sân lớn’.

Tiêu chí chọn doanh nghiệp tốt dưới ống kính đánh giá chuẩn quốc tế

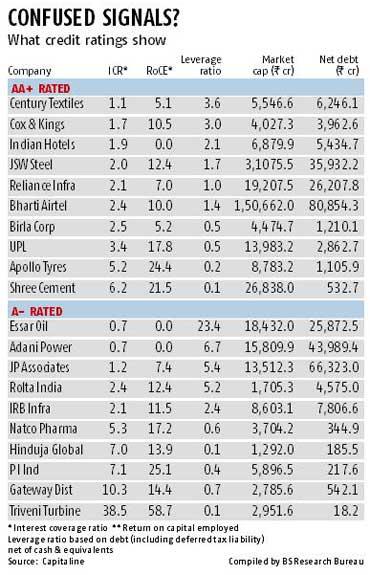

Trong phần chia sẻ của anh Thuân, tôi đặc biệt chú ý tới cách phân loại doanh nghiệp dựa trên bộ tiêu chí đánh giá độc lập, tương đồng với hệ thống của các tổ chức quốc tế như S&P hay Moody’s. Mỗi khi cân nhắc doanh nghiệp, Fin Rating áp dụng bộ chỉ tiêu rõ ràng: từ dòng tiền, năng lực trả nợ, quản trị doanh nghiệp đến ESG (Môi trường – Xã hội – Quản trị). Có thể hình dung đơn giản như sau:

| Rating criteria | Mục tiêu cụ thể |

|---|---|

| Dòng tiền hoạt động | Đảm bảo khả năng chi trả nợ vay và cổ tức |

| Đòn bẩy tài chính | Tránh rủi ro vỡ nợ khi thị trường biến động |

| Quản trị công ty | Minh bạch,có báo cáo tài chính đáng tin cậy |

| Bối cảnh ngành và thị trường | Ưu tiên ngành hưởng lợi từ chính sách hoặc xu thế dài hạn |

Chính sự hiện diện của các tổ chức xếp hạng độc lập như Fin Rating trên thị trường giúp nhà đầu tư như tôi ra quyết định trên nền tảng minh bạch và chuẩn hóa. Và cũng chính từ hệ tiêu chí đó, tôi bắt đầu điều chỉnh lại cách đánh giá cơ hội đầu tư của mình: không chỉ dựa vào cảm xúc, mà còn dựa vào những dữ liệu định lượng đã được chuẩn hóa – một mindset cực kỳ cần thiết để thích nghi với thị trường tài chính đang ngày càng chuyên nghiệp hóa khi Việt nam tiệm cận chuẩn thị trường mới nổi.

Những chỉ số tài chính cần theo dõi khi phân tích doanh nghiệp tốt

Tiêu chí tài chính phản ánh sức khỏe doanh nghiệp

Trong quá trình phân tích một doanh nghiệp tốt, tôi – Hiển – luôn chú trọng đến một số chỉ số tài chính cốt lõi đại diện cho nhiệt tim của công ty.Đặc biệt,dưới góc độ xếp hạng tín nhiệm như anh Nguyễn Quang Thuân (FinGroup,Fin Rating) chia sẻ,các tổ chức tài chính quốc tế thường dựa vào các nhóm chỉ tiêu bền vững để ra quyết định.Nếu bỏ qua chúng, việc đầu tư chẳng khác nào đi trong sương mù.

- ROE (Return on Equity) – Tỷ suất sinh lời trên vốn chủ sở hữu: Thể hiện khả năng sinh lợi từ đồng vốn cổ đông.ROE ổn định trên 15% là một chỉ báo tích cực.

- Tỷ lệ nợ/Vốn chủ sở hữu: Khiêm tốn nhưng hiệu quả, tỷ lệ này phản ánh khả năng kiểm soát đòn bẩy tài chính. Ngưỡng 1 – 1.5 được ưa chuộng bởi các tổ chức xếp hạng tín nhiệm.

- Dòng tiền tự do (free cash Flow): Một công ty có lợi nhuận nhưng thiếu dòng tiền là tín hiệu cảnh báo mạnh mẽ. Dòng tiền dương đều đặn thể hiện khả năng tự lập vượt rủi ro.

Góc nhìn thực tiễn từ các tổ chức xếp hạng độc lập

Một điểm khiến tôi rất tâm đắc trong buổi webinar vừa rồi chính là việc anh Thuân phân tích cách các tổ chức như Fin Rating tiếp cận doanh nghiệp hoàn toàn khác biệt. Họ không chỉ nhìn vào bề nổi mà còn đánh giá tính bền vững tài chính thông qua xác suất vỡ nợ, lịch sử dòng tiền và năng lực điều hành. Dưới đây là bảng tổng hợp ngắn gọn một số tiêu chí phổ biến theo tiêu chuẩn xếp hạng tín nhiệm quốc tế:

| Chỉ số | Ngưỡng an toàn | Ý nghĩa trong đánh giá |

|---|---|---|

| EBITDA/Chi phí lãi vay | >3 lần | Khả năng trả lãi mạnh, ít rủi ro tín dụng |

| Hệ số thanh toán hiện hành | >1.5 | Doanh nghiệp đủ tài sản ngắn hạn để chi trả nợ ngắn hạn |

| Lợi nhuận sau thuế biên (Net Margin) | Trên 10% | Thể hiện hiệu quả hoạt động kinh doanh thuần |

case study tiêu biểu phải kể đến là Công ty FPT. Nhiều năm liền, FPT giữ ROE trên 20%, nợ ở mức an toàn, dòng tiền từ hoạt động ổn định – điều khiến họ được đánh giá tích cực không chỉ từ nhà đầu tư cá nhân mà cả quỹ đầu tư quốc tế như Dragon Capital hay VinaCapital. Đây là mô hình đáng học hỏi để các doanh nghiệp trong nước hướng đến nếu muốn có mặt trong “danh mục chuẩn hóa” của tương lai khi thị trường nâng hạng.

Ứng dụng xếp hạng tín nhiệm để chọn trái phiếu và cổ phiếu an toàn

Xếp hạng tín nhiệm – Bước lọc đầu tiên khi chọn doanh nghiệp

Một trong những điểm tôi tâm đắc từ buổi webinar với anh Nguyễn Quang Thuân là tầm quan trọng của việc sử dụng xếp hạng tín nhiệm như một công cụ lọc hiệu quả để tìm kiếm các cổ phiếu và trái phiếu an toàn. Trong vai trò là nhà sáng lập và Chủ tịch Fin Rating – một tổ chức xếp hạng độc lập chuyên sâu cho thị trường việt Nam – anh Thuân không chỉ chia sẻ góc nhìn chuyên môn từ thị trường mà còn đưa ra các ví dụ thực tiễn, điển hình là các trường hợp doanh nghiệp có thứ hạng cao như VNM (Vinamilk) hay BIDV duy trì được độ tín nhiệm suốt nhiều năm nhờ tình hình tài chính vững mạnh và quản trị minh bạch.

Có thể thấy rằng,những chỉ số như EBITDA margin,debt-to-equity ratio, or cashflow từ hoạt động kinh doanh không chỉ đơn thuần là con số kế toán mà còn là yếu tố then chốt để tổ chức xếp hạng đánh giá. Dưới góc độ cá nhân, tôi cho rằng nếu mỗi nhà đầu tư nhỏ lẻ đều tiếp cận được các dữ liệu xếp hạng này, thì tỷ lệ “ôm hàng rác” sẽ giảm mạnh và thị trường sẽ phát triển lành mạnh hơn.

Áp dụng công cụ xếp hạng trong phân bổ danh mục đầu tư

Thay vì chạy theo sóng thông tin hoặc FOMO,tôi chọn một chiến lược cá nhân hóa: dùng bảng xếp hạng tín nhiệm như bản đồ chỉ đường để phân bổ danh mục đầu tư. Như anh Thuân nói rất đúng, đây là thời điểm đòi hỏi nhà đầu tư phải có lý trí và hệ thống tiếp cận thông tin tiêu chuẩn, vì thị trường đang bước vào giai đoạn kỳ vọng được nâng hạng MSCI.Từ những công cụ như Fin Rating, chúng ta có thể phân loại doanh nghiệp một cách trực quan, giảm thiểu cảm tính.

| Doanh nghiệp | Xếp hạng tín nhiệm | Loại sản phẩm | Gợi ý đầu tư |

|---|---|---|---|

| VietinBank | A- | Trái phiếu | Thu nhập cố định an toàn |

| FPT | A | Cổ phiếu | Giữ dài hạn, tăng trưởng bền vững |

| NVL | CCC | Trái phiếu | Tránh rủi ro tài chính |

Tôi tin rằng trong kỷ nguyên mới, khi công nghệ như hệ thống KRX được áp dụng và các dữ liệu minh bạch hơn, thì việc tích hợp công cụ xếp hạng tín nhiệm vào chiến lược đầu tư sẽ trở thành tiêu chuẩn. Bởi lẽ, giống như kiểm toán tài chính, nó mang lại một lớp bảo vệ vô hình nhưng cần thiết cho từng quyết định đầu tư.

Những suy nghĩ còn đọng lại

Việc lựa chọn một doanh nghiệp đáng tin cậy không chỉ là nghệ thuật phân tích số liệu, mà còn đòi hỏi sự nhạy bén trong việc đọc hiểu xếp hạng tín nhiệm – một chỉ số phản ánh sức khỏe tài chính và khả năng đáp ứng cam kết của doanh nghiệp. khi biết tận dụng thông tin này kết hợp với góc nhìn tổng thể về thị trường, bạn sẽ có thêm một “la bàn” đáng tin cậy để điều hướng trong hành trình đầu tư hoặc hợp tác kinh doanh.

Đừng ngần ngại thực hành kỹ năng này trong cuộc sống, bắt đầu từ việc xem xét báo cáo tài chính, hiểu rõ vai trò của các tổ chức xếp hạng tín nhiệm và so sánh các doanh nghiệp trong cùng ngành. Đây cũng là dịp để bạn rèn luyện tư duy phân tích, đồng thời nâng cao khả năng đánh giá một cách khách quan và chiến lược.

Nếu bạn quan tâm đến các chủ đề liên quan như cách phân biệt giữa xếp hạng tín nhiệm nội địa và quốc tế, hay tác động của các thay đổi vĩ mô tới xếp hạng doanh nghiệp, đó sẽ là những hướng nghiên cứu bổ ích để đào sâu thêm kiến thức.

chúng tôi rất mong muốn lắng nghe quan điểm và những kinh nghiệm thực tế từ bạn. Hãy chia sẻ suy nghĩ trong phần bình luận bên dưới, hoặc cùng nhau thảo luận để mở rộng góc nhìn và cùng học hỏi.