QR Pay banks like Agribank, BIDV, Vietcombank, Vietinbank help with fast, secure, and convenient payments. Users save transaction time, suitable for cashless payment trends. According to the State Bank report, QR payments grow 120% every year. This is an important digital transformation trend in the financial sector.

DPS.MEDIA has consulted hundreds of SME businesses to apply QR Pay solutions to enhance customer experience. This helps increase revenue and optimize operating costs.

Discover the superior features of QR Pay in modern banking transactions

Outstanding features of QR Pay in banking transactions

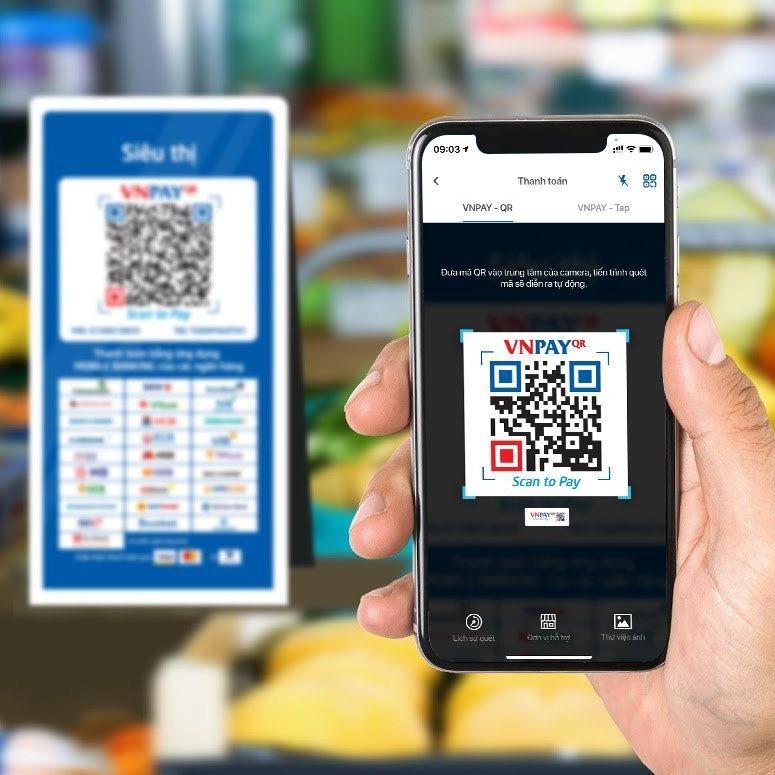

QR Pay brings superior convenience with fast and secure payment capabilities. Customers just need to scan the QR code with their phone, no need to enter fees or complex operations. This feature is widely supported by major banks like Agribank, BIDV, Vietcombank, Vietinbank, meeting daily life payment needs.

- Transaction time only 2-5 seconds

- Ensure account security with advanced encryption

- Integrate diverse services such as bill payments, shopping, transfers

- Limit cash contact, suitable in the context of the epidemic

Checklist when using QR Pay to optimize experience

- Activate QR Pay feature on the banking app you are using

- Check stable internet connection before transacting

- Scan QR code accurately, do not use codes of unknown origin

- Set password or biometric authentication to protect account

- Keep banking app updated to enjoy the latest features

Compare QR Pay features at four popular banks

| Bank | Payment time | Transaction fee | Transaction limit |

|---|---|---|---|

| Agribank, | ~3 seconds | Free | 50 million VND/day |

| BIDV, | ~2 seconds | Free | 100 million VND/day |

| Vietcombank | ~3 seconds | Free | 70 million VND/day |

| Vietinbank | ~4 seconds | Free | 80 million VND/day |

An anonymous customer from Ho Chi Minh City said that using QR Pay via Agribank saves an average of 15 minutes per day on shopping transactions, suitable for the current busy schedule (Source: Vietnam Fintech Report 2023).

Takeaway: QR Pay is an effective payment solution, suitable for the cashless transaction trend but needs attention to security and information verification.

Compare features and advantages of QR Pay from Agribank BIDV Vietcombank and Vietinbank

Compare QR Pay features of Agribank, BIDV, Vietcombank and vietinbank

QR Pay is a payment method widely developed by major banks, enabling fast and convenient transactions. In Vietnam, banks Agribank, BIDV, Vietcombank and Vietinbank all deploy this service with many similarities and differences in features.

– Agribank QR Pay focuses on a vast network, suitable for rural customers with low transaction fees.- BIDV stands out with diverse payment channel integration, including e-wallets.

– Vietcombank provides a smooth user experience, integrated in VCB Digibank app with enhanced high-security features.

– Vietinbank QR Pay supports international payments, targeting business customers and individual traders.

Outstanding advantages and points to note

- Agribank: Low fees, easy access, supports rural customers; however, transaction processing speed may be slower in some areas.

- BIDV: Diverse payment methods, integrates many supplementary financial services; still needs to improve app interface for better user-friendliness.

- Vietcombank: High security, fast payments, developed digital ecosystem; but transaction fees are slightly high for some small transactions.

- Vietinbank: Supports domestic and international payments, suitable for businesses; interface and experience still have some minor limitations in flexibility.

– Always check the QR code of the correct bank and payment point.

– Use a secure network connection to avoid the risk of information theft.

– Update the app regularly for a better experience and enhanced security.

Checklist for selecting suitable QR Pay

- Determine the payment purpose: personal or business

- Evaluate coverage area and customer support

- Check transaction fees and accompanying security features

- Prioritize banks with easy-to-use apps and expanded ecosystems

- Refer to feedback from real users to avoid system error risks

| Bank | Transaction fee | Scope of application | Outstanding features | Security quality |

|---|---|---|---|---|

| Agribank, | Low (~0.1%) | Nationwide, many rural branches | Simple payment, supports QR fee collection | National standard, with OTP authentication |

| BIDV, | Medium (0.15%) | About 90% provinces and cities | Link to e-wallets, multi-channel payment | PCI DSS certified |

| Vietcombank | Higher (~0.2%) | Large coverage, many partners | Digibank app integrates many utilities | SSL encryption technology, 2-layer security |

| Vietinbank | 0.15% – 0.2% | Wide coverage, international support | International payment, suitable for businesses | Multi-layer security, complies with international standards |

Real example: A customer in Hanoi shared after using QR Pay Vietcombank to pay for shopping at the supermarket, the payment only took under 5 seconds, significantly reducing queuing time compared to using cash. (Source: State Bank of Vietnam Report, 2023)

Note: QR Pay payment also has risks such as scanning fake QR codes or unstable network, users need to be vigilant when transacting.

Takeaway: Each bank has its own strengths in QR Pay, users should consider fees, utilities, and coverage area to choose the most suitable service.

Guide to using QR Pay for fast and secure payments for SMEs

How to activate and use QR Pay on banking app

To get started, customers need to download a banking app that supports QR Pay such as Agribank, BIDV, Vietcombank or Vietinbank. After successfully registering and logging in, users perform the following steps:

- Select the QR Pay payment option in the app

- Scan the QR code at the point of sale or enter the QR code manually

- Confirm the amount and complete the payment instantly

This helps reduce waiting time and limit cash contact, suitable for SMEs needing quick and simple transactions.

Advantages and notes when using QR Pay for SMEs

Main advantages of Bank QR Pay are fast processing speed and security thanks to encryption technology. According to the report State Bank 2023, over 60% non-cash transactions in Vietnam use QR Pay. SMEs applying this technology will:

- Save operating costs compared to traditional POS machines

- Easily track transaction history through the banking app

- Minimize loss risks due to cash

Checklist for effective QR Pay deployment for small businesses

To successfully implement QR Pay, SMEs should follow these steps:

| Category | Description | Time |

|---|---|---|

| Register for QR Pay service | contact the bank to open an account and issue QR code | 1-3 days |

| Staff training | Guide on how to scan and process transactions on the app | 1 day |

| Promote payment method | Notify customers about QR Pay via social media, signage | Customizable |

Takeaway: Using QR Pay is a smart step that helps SMEs enhance customer experience and optimize operating costs in the digital era.

Strategy for applying QR Pay in business to enhance customer experience

Advantages of using QR Pay in business

Applying QR Pay from banks such as Agribank, BIDV, Vietcombank, Vietinbank helps businesses shorten payment time, increase convenience for customers. According to the State Bank report (2023), QR Pay transactions grew 45% compared to the previous year, demonstrating user preference. Through QR Pay, businesses can easily track cash flow and manage revenue more accurately.

How to implement effective QR Pay strategy

Some practical steps to apply QR Pay to business:

– Choose a reputable QR Pay provider, integrated with multiple banks.

– Train cashiers to guide customers on proper usage.

– Place QR code in an easily visible position, convenient for payment operations.

– Combine promotions for customers paying via QR Pay to increase successful transaction rates.

– Regularly monitor and evaluate effectiveness through payment reports.

Checklist for applying QR Pay in business

| Goal | Action |

|---|---|

| Select suitable bank | Agribank, BIDV, Vietcombank, Vietinbank |

| Staff training | Guide quick and accurate QR Pay operations |

| Arrange QR code | Easily recognizable position, convenient for customer operations |

| Promotions, offers | Apply to encourage cashless payments |

| Check and maintain | Ensure QR code always works well, without errors |

Challenges and notes when deploying QR Pay

Although QR Pay brings many conveniences, businesses need to note risks such as:

– Risk of information insecurity if not choosing a reputable partner.

– Customers unfamiliar may encounter difficulties in the first operation.

– Network congestion may interrupt the payment process affecting experience.

For example, a retail store in Hanoi reduced 30% waiting time for payment after 3 months of applying QR Pay, but also recorded 5% failed transactions due to weak network (Source: Internal financial report, 2023).

Analysis of QR Pay's impact on financial management efficiency for small and medium enterprises

Positive impact of QR Pay on financial management

QR Pay at banks like Agribank, BIDV, Vietcombank and Vietinbank has created a major breakthrough in optimizing financial management for small and medium enterprises (SMEs). With fast and easy payment capability, QR Pay helps reduce transaction processing time, while limiting errors compared to traditional methods.

This contributes significantly to improving cash flow and more effective cost management.

Checklist for applying QR Pay in SMEs financial management

- Register a bank account supporting QR Pay and link it with accounting software.

- Set up cash flow process via QR Code for easy cash flow control.

- Train staff to use QR Pay payment system correctly.

- Monitor and reconcile daily transactions to detect abnormalities promptly.

- Periodically evaluate effectiveness and adjust processes to optimize capital sources.

Real-world examples and challenges to note

An SME business in Hanoi using QR Pay Vietcombank recorded a 40% reduction in payment processing time compared to before (State Bank Report, 2023). However, data security challenges and fraud risks still need to be tightly controlled to avoid financial losses.

| Bank | Payment time reduction rate | Main advantages |

|---|---|---|

| Agribank, | 35% | Easy integration with POS system |

| BIDV, | 38% | Multi-channel payment support |

| Vietcombank | 40% | High security, fast and concise process |

| Vietinbank | 37% | Convenient online transaction management |

Takeaway: QR Pay not only shortens payment time but also enhances financial management efficiency for SMEs, as long as security and operational processes are strictly maintained.

Advice for optimally selecting suitable bank QR Pay for your business model

Assess needs and characteristics of business model

Before choosing bank QR Pay, clearly determine payment needs and business scale. For retail models, high-frequency transactions need to prioritize fast processing speed and low conversion fees. Service businesses may care more about convenience and multi-platform support than costs.

Criteria for selecting suitable bank

Factors to consider when selecting a bank include:

– QR Pay transaction fees and system maintenance costs

– Coverage of the customer network using that bank's app

– Stability and actual transaction processing speed

– Technical support and partner incentive policies

Check feedback from same-industry business customers to avoid choosing a bank with slow processing times or limited support, affecting the payment experience.

Checklist for selecting QR Pay suitable for business model

- Determine business type and scale (retail, service, F&B…)

- Compare QR Pay transaction fees between banks like Agribank, BIDV, Vietcombank, Vietinbank

- Check compatibility with current sales management software

- Evaluate customer support capability and quick issue resolution

- Refer to the popular QR Pay acceptance rate in the area or industry

| Bank | QR Pay transaction fee | Main advantages | Limitation |

|---|---|---|---|

| agribank | 0.2% – 0.3% | wide rural coverage, competitive fees | Processing speed not as fast as Joint Stock Commercial Bank |

| BIDV, | 0.2% – 0.25% | Stable system, good business support | Device maintenance fees may be high for small businesses |

| Vietcombank | 0.15% – 0.2% | Fast payment, popular app, high reputation | Complex registration procedures required |

| Vietinbank | 0.2% – 0.3% | High security, good customer service | Sometimes promotions not accurately updated |

Real examples and risk warnings

An F&B store in Ho Chi Minh City chose Vietcombank QR Pay, helping increase non-cash payment revenue by 25% in 3 months (according to Vietcombank 2023 report). However, the store owner also noted that the initial registration process takes a lot of time. Moreover, there is a risk of service interruption without notice if periodic reports are not completed, affecting operations.

Takeaway: Choice Bank QR Pay suitable to optimize payment efficiency, but need to carefully consider costs, speed and support to ensure stable business operations.

Trends in development and prospects of QR Pay in Vietnam's digital banking ecosystem

Overview of trends QR Pay in digital banking

In recent years, QR Pay is increasingly becoming a popular payment method in Vietnam. According to the Vietnam Payment Report 2023, the transaction volume via QR code at major banks such as agribank, BIDV, Vietcombank and Vietinbank has grown more than 40% compared to the previous year. Integrating QR Pay into the digital ecosystem enhances customer experience, minimizes direct contact, and accelerates digital transformation.

Development prospects and points to note

Banks are focusing on expanding the QR Pay acceptance network through many channels, from supermarkets, convenience stores to public services. However, there are still challenges such as:

- Security issues and fraud in QR code payments

- Lack of synchronization of QR code standards between banks

- Limited coverage in rural areas, where Internet infrastructure is still lacking

Checklist for effective QR Pay development in Vietnamese banks

- Apply national QR code standard (NHNN) to increase inter-bank integration

- Promote user education on safety in digital payments

- Expand cooperation with diverse payment acceptance points

- Invest in upgrading security, real-time transaction monitoring

- Develop fast and effective customer support services

| Bank | Number of QR Pay acceptance points | QR Pay transaction growth 2023 (%) |

|---|---|---|

| Agribank, | 15,000+ | 38% |

| BIDV, | 12,500+ | 42% |

| Vietcombank | 18,000+ | 45% |

| Vietinbank | 14,700+ | 40% |

Practical example: A customer in Hanoi shared that after switching to Vietcombank's QR Pay, he frequently pays at markets and coffee shops faster and more conveniently than cash or cards. This reflects the increasing trend of QR code payment acceptance in daily life. (Source: Vietnam Payment Report 2023, NHNN)

Takeaway: QR Pay is a fast, convenient payment solution with strong development potential in Vietnam's bank digital ecosystem, but needs improvements in security and infrastructure to optimize efficiency.

Things still under consideration

QR Pay at Agribank, BIDV, vietcombank and Vietinbank enables faster, more convenient and safer payments. This is the optimal solution for modern users.

Try using QR Pay today to experience the convenience in electronic payments. Register and explore the superior features of your chosen bank.

You can learn more about digital payment trends and digital marketing solutions for SMEs. These topics will help businesses develop more sustainably.

DPS.MEDIA always accompanies you on the digital transformation journey. Don't forget to leave comments sharing opinions or questions to discuss together!