Cách thanh toán QR Pay tại Agribank, BIDV, Techcombank, Vietcombank và Vietinbank giúp giao dịch nhanh chóng, an toàn và tiện lợi hơn bao giờ hết.

Theo báo cáo, thanh toán qua QR tăng trưởng 120% trong năm 2023, chứng tỏ xu hướng chuyển đổi số trong ngân hàng ngày càng mạnh mẽ.

DPS.MEDIA đã đồng hành tư vấn hàng trăm SMEs áp dụng QR pay để tối ưu trải nghiệm khách hàng và nâng cao hiệu quả thanh toán. Điều này khẳng định tầm quan trọng của giải pháp QR Pay trong kinh doanh hiện đại.

Tổng quan về QR Pay và ứng dụng trong thanh toán ngân hàng tại Việt Nam

Khái niệm và lợi ích của QR Pay trong thanh toán ngân hàng

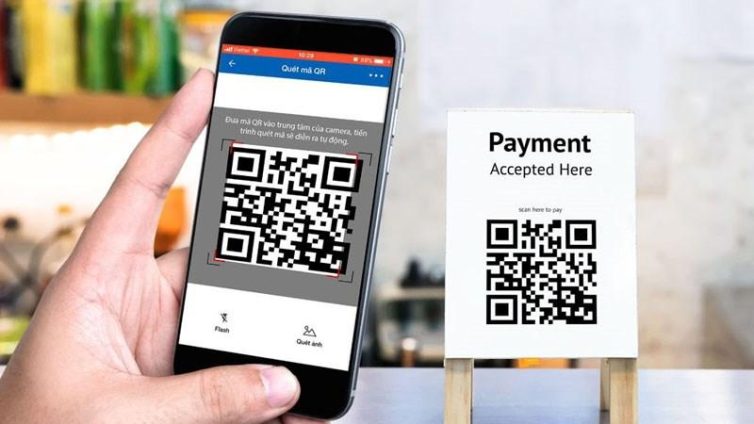

QR Pay là phương thức thanh toán nhanh qua mã QR, được nhiều ngân hàng tại Việt nam áp dụng nhờ tính tiện lợi và bảo mật. Người dùng chỉ cần quét mã QR trên ứng dụng ngân hàng, không cần tiền mặt hay thẻ tín dụng.QR Pay giúp giảm thời gian chờ đợi, đồng thời hạn chế tiếp xúc trực tiếp, phù hợp với xu hướng thanh toán không tiền mặt hiện nay.

- Thanh toán nhanh, chỉ mất 5-10 giây/giao dịch

- Tương thích đa nền tảng: app ngân hàng, ví điện tử

- Hỗ trợ nhiều giao dịch: mua hàng, thanh toán hóa đơn, chuyển tiền

- Bảo mật cao với xác thực đa lớp

Ứng dụng thực tế tại các ngân hàng lớn Việt Nam

Tại Việt Nam, các ngân hàng như Agribank, BIDV, Techcombank, Vietcombank, Vietinbank đều tích hợp QR Pay vào ứng dụng của mình. Ví dụ, BIDV ghi nhận hơn 3 triệu giao dịch QR Pay trong 2023, tăng trưởng 25% so với năm trước (Báo cáo BIDV 2023). Khách hàng có thể dễ dàng thanh toán tại siêu thị, cửa hàng tiện lợi hoặc trực tuyến.

Checklist sử dụng QR Pay hiệu quả

- Cập nhật ứng dụng ngân hàng thường xuyên để tránh lỗi

- Kiểm tra mạng internet ổn định để thực hiện giao dịch

- Xác minh chính xác mã QR trước khi thanh toán

- Hạn chế chia sẻ thông tin QR Code không rõ nguồn gốc

- Lưu giữ biên lai điện tử để đối chiếu khi cần

| Bank | Ứng dụng QR Pay | Outstanding features |

|---|---|---|

| Agribank, | Agribank E-Mobile Banking | Thanh toán đa kênh, bảo mật OTP |

| BIDV, | BIDV SmartBanking | Hỗ trợ QR pay cho nhiều mục đích |

| Techcombank, | Techcombank Mobile | Giao diện thân thiện, thanh toán nhanh |

| Vietcombank | Vietcombank Smart Banking | Bảo mật cao, nhiều ưu đãi QR Pay |

| Vietinbank | VietinBank iPay | thanh toán linh hoạt, hỗ trợ QR code tĩnh và động |

Takeaway: QR Pay đang trở thành công cụ thanh toán quan trọng, giúp người dùng Việt Nam tiết kiệm thời gian và nâng cao trải nghiệm giao dịch hàng ngày.

so sánh quy trình thanh toán QR Pay tại Agribank BIDV Techcombank Vietcombank và Vietinbank

Quy trình thanh toán QR Pay tại các ngân hàng

Tất cả ngân hàng đều hỗ trợ quét mã QR để thanh toán nhanh chóng, tuy nhiên quy trình có sự khác biệt nhẹ về thao tác và ứng dụng đi kèm. Ví dụ, Agribank, and Vietcombank cho phép thanh toán qua ứng dụng riêng hoặc app hỗ trợ đa ngân hàng. Trong khi đó, BIDV,, Techcombank, and Vietinbank yêu cầu sử dụng app chính chủ để bảo mật tối đa.

Các bước chung khi thanh toán QR Pay:

- Mở ứng dụng ngân hàng,chọn chức năng quét mã QR.

- Hướng camera vào mã QR tại cửa hàng hoặc điểm giao dịch.

- Xác nhận số tiền và nhấn “Thanh toán”.

- nhận thông báo xác nhận giao dịch thành công.

So sánh tính năng và ưu điểm từng ngân hàng

- agribank: Dễ thao tác trên app Agribank E-Mobile Banking, phù hợp với người dùng lần đầu. Hỗ trợ thanh toán mọi hóa đơn/đơn hàng có QR code chuẩn.

- BIDV,: Ứng dụng BIDV Smart Banking có thêm tùy chọn lưu mã QR yêu thích, hỗ trợ thanh toán nhanh trong lần sau.

- Techcombank,: Hỗ trợ đa dạng QR code quốc tế, tương thích các nền tảng như VietQR, POS chuẩn EMV.

- Vietcombank: Tích hợp nhanh với QR Pay trên app VCB Digibank, hỗ trợ chuyển tiền nhanh qua mã QR cá nhân và doanh nghiệp.

- Vietinbank: Tính năng bảo mật cao với xác thực sinh trắc học trước khi thanh toán, hạn chế rủi ro gian lận.

Checklist thanh toán QR Pay an toàn và hiệu quả

- Kiểm tra mã QR: Chỉ quét mã QR từ nguồn tin cậy,tránh mã giả.

- Xác nhận số tiền: Luôn đối chiếu số tiền chính xác trước khi xác nhận.

- Cập nhật app ngân hàng mới nhất: Đảm bảo tính năng bảo mật và tiện ích tối ưu.

- Tránh sử dụng WiFi công cộng: Khi thanh toán, nên dùng mạng riêng hoặc dữ liệu di động để bảo mật thông tin.

- Lưu lại biên nhận điện tử: Trong trường hợp phát sinh sự cố hoặc tranh chấp.

| Bank | Main Application | Outstanding features | Security |

|---|---|---|---|

| Agribank, | Agribank E-Mobile Banking | Thanh toán hóa đơn đa dạng | Xác thực OTP |

| BIDV, | BIDV Smart Banking | Lưu mã QR yêu thích | Xác thực OTP + Sinh trắc học |

| Techcombank, | Techcombank Mobile | Hỗ trợ nhiều QR chuẩn | Xác thực OTP + Biometric |

| Vietcombank | VCB Digibank | Chuyển tiền nhanh qua QR cá nhân | Xác thực đa yếu tố |

| Vietinbank | VTB SmartBanking | Bảo mật cao, sinh trắc học | Đa tầng bảo mật |

Takeaway

Mỗi ngân hàng đều có ưu thế riêng trong quy trình thanh toán QR Pay, chủ yếu xoay quanh trải nghiệm người dùng và bảo mật. Việc lựa chọn ngân hàng phù hợp nên dựa trên nhu cầu cá nhân và mức độ an toàn mong muốn khi thực hiện giao dịch.

Hướng dẫn chi tiết từng bước kích hoạt và sử dụng QR Pay trên ứng dụng ngân hàng phổ biến

Kích hoạt QR Pay trên ứng dụng Agribank

Để sử dụng QR Pay trên Agribank E-Mobile banking,khách hàng cần đăng nhập tài khoản và thực hiện các bước sau:

- Vào mục “Thanh toán” và chọn “QR Pay”.

- quét mã QR tại điểm bán hàng hoặc nhập mã thủ công.

- Xác nhận số tiền và hoàn tất giao dịch bằng mã OTP.

Các bước dễ thực hiện, phù hợp với đa số người dùng và an toàn với xác thực đa lớp.

Kích hoạt và dùng QR Pay trên BIDV SmartBanking

Khách hàng BIDV nên cập nhật app lên phiên bản mới nhất để trải nghiệm QR Pay mượt mà. Quy trình gồm:

- Truy cập mục “Thanh toán nhanh” chọn “QR Pay”.

- Quét mã QR hoặc chọn mã đã lưu trước đó.

- Xác nhận,nhập mật khẩu hoặc OTP để hoàn thành giao dịch.

BIDV hỗ trợ nhiều loại ví điện tử liên kết,giúp thanh toán linh hoạt và tiện lợi hơn.

Hướng dẫn kích hoạt QR Pay Techcombank, Vietcombank và Vietinbank

- Techcombank F@st Mobile: Truy cập “Thanh toán QR”, quét mã, xác nhận đơn hàng.

- Vietcombank SmartBanking: Chọn “Thanh toán”, ấn vào QR Pay, thao tác tương tự như trên.

- Vietinbank iPay: Vào mục “QR Pay”, quét mã QR, nhập mã OTP xác nhận.

Những ngân hàng này đều hỗ trợ bảo mật OTP và mã PIN giúp giảm thiểu rủi ro gian lận.

Checklist khi sử dụng QR Pay

- Đảm bảo điện thoại có kết nối internet ổn định.

- Cập nhật app ngân hàng lên phiên bản mới nhất.

- Xác minh số điện thoại và đăng ký dịch vụ ngân hàng điện tử đầy đủ.

- kiểm tra kỹ thông tin giao dịch trước khi xác nhận.

- Sử dụng mật khẩu và mã OTP bảo mật cho mọi giao dịch.

| Bank | Application | Ưu điểm QR Pay |

|---|---|---|

| agribank | E-Mobile Banking | Giao diện thân thiện, OTP xác thực 2 lớp |

| BIDV, | SmartBanking | Liên kết ví điện tử, hỗ trợ QR đa dạng |

| Techcombank, | F@st Mobile | Bảo mật cao, thao tác nhanh |

| Vietcombank | SmartBanking | Giao diện trực quan, cập nhật thường xuyên |

| Vietinbank | iPay | Hỗ trợ thanh toán đa kênh, an toàn |

Phân tích ưu nhược điểm các tính năng bảo mật khi thanh toán qua QR Pay ở từng ngân hàng

Ưu điểm và nhược điểm bảo mật khi QR Pay của Agribank và BIDV

Agribank ứng dụng công nghệ mã QR động, giúp giảm nguy cơ gian lận nhờ mã QR tự đổi sau mỗi giao dịch.Tuy nhiên, nhiều người dùng phản ánh tính năng bảo mật OTP vẫn chưa được tối ưu, đôi khi gây gián đoạn khi mạng yếu. BIDV nổi bật với hệ thống xác thực đa lớp, bao gồm mã PIN và sinh trắc học, tăng cường bảo vệ tài khoản. Nhưng điểm hạn chế là quy trình xác thực đôi lúc kéo dài, tạo cảm giác bất tiện khi thanh toán nhanh.

- Agribank: QR động, bảo mật trung bình, hỗ trợ OTP

- BIDV: Xác thực đa lớp, sinh trắc học, nhưng quy trình dài

Nét đặc trưng bảo mật QR Pay ở Techcombank và Vietcombank

Techcombank sử dụng công nghệ mã QR với tiêu chuẩn bảo mật quốc tế PCI DSS, giúp mã hóa toàn bộ dữ liệu giao dịch. Đây là điểm cộng lớn nhưng cũng khiến một số giao dịch bị chậm khi tải mã. Vietcombank ưu tiên xác thực qua ứng dụng VCB Digibank, tích hợp nhiều lớp kiểm tra như OTP, Face ID. Tuy nhiên, rủi ro từ các thiết bị bị nhiễm mã độc khi khách hàng sử dụng chưa được cảnh báo kỹ.

- Techcombank: Chuẩn PCI DSS, mã hóa cao, tốc độ tải đôi khi chậm

- Vietcombank: OTP, face ID, dễ dàng nhưng tiềm ẩn nguy cơ mã độc

Bảo mật QR Pay Vietinbank & checklist tăng cường an toàn

Vietinbank triển khai xác thực kép với câu hỏi bảo mật và mã OTP, giúp ngăn chặn truy cập trái phép. Nhờ vậy, tỷ lệ gian lận giảm khoảng 15% theo báo cáo ngân hàng Nhà nước 2023. Tuy nhiên, cấu hình bảo mật nhiều bước cũng khiến người dùng mới cảm thấy rườm rà. Để tối ưu an toàn, khách hàng nên kiểm tra kỹ địa chỉ QR và cập nhật phần mềm thường xuyên.

- Kiểm tra mã QR có rõ nguồn gốc, không mờ hay thay đổi bất thường

- Bật tính năng xác thực đa lớp hoặc sinh trắc học nếu được hỗ trợ

- Cập nhật ứng dụng ngân hàng và hệ điều hành thiết bị thường xuyên

- Không cung cấp thông tin cá nhân hoặc mã OTP cho người lạ

| ngân hàng | Ưu điểm bảo mật | Nhược điểm bảo mật |

|---|---|---|

| Agribank, | Mã QR động giảm gian lận | OTP đôi lúc không ổn định |

| BIDV, | Xác thực đa lớp, sinh trắc học | Thao tác xác thực hơi lâu |

| Techcombank, | Chuẩn PCI DSS, mã hóa cao | Tốc độ tải mã QR chậm |

| Vietcombank | OTP, Face ID đơn giản, tiện lợi | Nguy cơ mã độc từ thiết bị |

| Vietinbank | Xác thực kép giảm gian lận 15% | Quy trình bảo mật phức tạp |

Lời khuyên về cách quản lý giao dịch và hạn chế rủi ro khi sử dụng QR Pay

Thiết lập giới hạn & theo dõi giao dịch thường xuyên

To quản lý giao dịch hiệu quả khi sử dụng QR Pay, người dùng nên cài đặt giới hạn thanh toán hàng ngày trên ứng dụng ngân hàng. Việc này hạn chế rủi ro khi có lỗi phát sinh hoặc thao tác sai sót. Đồng thời, kiểm tra lịch sử giao dịch ít nhất 1 lần mỗi ngày giúp phát hiện kịp thời biểu hiện bất thường.

Kiểm tra & xác minh thông tin mã QR trước khi thanh toán

Trước khi quét, hãy xác định mã QR là từ nguồn đáng tin cậy như cửa hàng hoặc trang chính thức. Tránh quét các mã QR được gửi qua mạng xã hội hoặc tin nhắn lạ vì có thể gây rủi ro mất tiền. Ví dụ, một khảo sát của Bảo hiểm an ninh mạng Việt Nam năm 2023 cho thấy 15% người dùng bị mất tiền do quét nhầm mã QR giả mạo.

Checklist giảm thiểu rủi ro khi dùng QR Pay

- Đặt giới hạn giao dịch tối đa hàng ngày (tối ưu 2-5 triệu đồng)

- Kích hoạt cảnh báo giao dịch từ ngân hàng (SMS, email)

- Không chia sẻ mã QR cá nhân hoặc hình ảnh mã với người lạ

- Chỉ quét mã QR chính thức, tránh các link rút gọn hoặc mã không rõ nguồn

- Thường xuyên cập nhật phần mềm ngân hàng để bảo mật tốt hơn

- Liên hệ ngay hotline ngân hàng khi phát hiện giao dịch bất thường

| Bank | Giới hạn thanh toán (VNĐ/ngày) | Cảnh báo đa kênh |

|---|---|---|

| Agribank, | 5,000,000 | SMS & Ứng dụng |

| BIDV, | 3,000,000 | Email & SMS |

| Techcombank, | 5,000,000 | Ứng dụng & Email |

| Vietcombank | 3,000,000 | SMS, Email |

| Vietinbank | 4,000,000 | SMS & Ứng dụng |

Xu hướng phát triển thanh toán không tiền mặt và vai trò của QR Pay trong chiến lược digital marketing doanh nghiệp

Xu hướng phát triển thanh toán không tiền mặt tại Việt Nam

Việt Nam chứng kiến sự tăng trưởng nhanh chóng của thanh toán không tiền mặt, đặc biệt trong bối cảnh chuyển đổi số mạnh mẽ. Theo báo cáo của Statista (2023), tỷ lệ người dùng ví điện tử và QR Pay đã tăng hơn 35% so với năm trước. Các ngân hàng lớn như agribank, BIDV, Techcombank, Vietcombank, Vietinbank đều đẩy mạnh tích hợp QR Pay để nâng cao tiện ích khách hàng.

- Tăng cường giao dịch nhanh chóng, tiện lợi

- Giảm thiểu rủi ro về truyền nhiễm trong đại dịch

- Hỗ trợ thương mại điện tử và chi tiêu trực tuyến ngày càng phổ biến

Vai trò của QR Pay trong chiến lược digital marketing doanh nghiệp

QR pay không chỉ là công cụ thanh toán mà còn là kênh tiếp cận khách hàng hiệu quả trong digital marketing. QR code giúp doanh nghiệp kết nối trực tiếp với khách hàng thông qua:

- Chương trình khuyến mãi, tích điểm tự động

- Thu thập dữ liệu mua hàng chính xác và nhanh chóng

- Tăng trải nghiệm mua sắm đa kênh, nâng cao nhận biết thương hiệu

Một thương hiệu F&B tại Hà Nội áp dụng QR Pay kết hợp chiến dịch giảm giá đã tăng 20% doanh số chỉ sau 3 tháng (Nguồn: Báo cáo Fintech Việt Nam, 2023).

Checklist chuẩn bị triển khai QR Pay trong chiến lược digital marketing

- Xác định các ngân hàng đối tác (Agribank, BIDV, Techcombank, Vietcombank, Vietinbank)

- Tích hợp QR Pay vào ứng dụng, website hoặc tại điểm bán hàng

- Đào tạo nhân viên hướng dẫn khách hàng sử dụng QR Pay

- Thiết kế chương trình ưu đãi, khuyến mãi kèm QR code

- Đánh giá và tối ưu liên tục dựa trên dữ liệu giao dịch

| Bank | Loại QR Pay hỗ trợ | Key Advantages |

|---|---|---|

| Agribank, | Agribank ATM QR Pay | Phổ biến rộng rãi, tích hợp dễ dàng |

| BIDV, | QR Pay BIDV SmartBanking | Thanh toán nhanh, an toàn |

| Techcombank, | QR Pay Techcombank Mobile | Phù hợp thương mại điện tử |

| Vietcombank | QR Pay VCB Digibank | giao diện thân thiện, dễ sử dụng |

| Vietinbank | QR Pay Vietinbank iPay | Đa dạng dịch vụ tiện ích |

Takeaway: QR Pay là cú hích mạnh mẽ trong việc số hóa thanh toán và thúc đẩy digital marketing,nếu được triển khai bài bản sẽ đem lại lợi ích lâu dài cho doanh nghiệp.

Chia sẻ kinh nghiệm tối ưu hóa trải nghiệm khách hàng qua thanh toán QR Pay trong thương mại điện tử SMEs

Hiểu về lợi ích của thanh toán QR Pay trong SMEs

payment QR Pay giúp doanh nghiệp nhỏ và vừa (SMEs) rút ngắn thời gian giao dịch, giảm thiểu rủi ro tiền mặt và tăng trải nghiệm khách hàng. Theo báo cáo Ngân hàng Nhà nước Việt Nam (2023), thanh toán QR có tốc độ giao dịch nhanh hơn 40% so với phương thức truyền thống, đồng thời nâng cao tính bảo mật nhờ xác thực hai lớp. Việc tích hợp QR Pay trên nền tảng thương mại điện tử giúp SMEs mở rộng kênh bán hàng và tăng tỷ lệ chuyển đổi đơn hàng.

Các bước tối ưu hóa trải nghiệm qua QR pay

Để tối ưu trải nghiệm thanh toán QR pay, SMEs cần chú ý:

- Dễ dàng sử dụng: Giao diện quét mã trực quan, hướng dẫn rõ ràng, phù hợp với mọi đối tượng khách hàng.

- Hỗ trợ đa ngân hàng: Cho phép thanh toán qua QR Pay của Agribank,BIDV,Techcombank,Vietcombank,Vietinbank,…

- Tích hợp nhanh: Đồng bộ với hệ thống quản lý đơn hàng và thanh toán để giảm sai sót, tự động cập nhật trạng thái đơn.

- Security: Áp dụng mã hóa và xác thực người dùng để phòng tránh gian lận.

Checklist hành động cho SMEs

| Step | Goal | Note |

|---|---|---|

| 1 | Chọn đối tác ngân hàng tích hợp QR Pay | Ưu tiên các ngân hàng lớn như Agribank, BIDV, Techcombank… |

| 2 | Tối ưu UI/UX thanh toán trên website/app | Giao diện đơn giản, hợp với nhiều thiết bị |

| 3 | Đào tạo nhân viên tư vấn thanh toán | Giúp khách hàng yên tâm, giảm lỗi trong giao dịch |

| 4 | Theo dõi và phân tích dữ liệu giao dịch QR Pay | Đánh giá hiệu quả, phát hiện sự cố nhanh |

Vấn đề cần lưu ý và ví dụ thực tiễn

Một SME kinh doanh đồ gia dụng tại Hà Nội chia sẻ, sau 3 tháng áp dụng thanh toán QR Pay đa ngân hàng, doanh thu online tăng 18% và thời gian thanh toán giảm trung bình 35 giây mỗi đơn. Tuy nhiên, họ cũng gặp khó khăn trong việc đồng bộ dữ liệu giữa két sổ offline và hệ thống trực tuyến, gây nhầm lẫn ban đầu. Ngoài ra, rủi ro về gián đoạn mạng hoặc lỗi quét mã vẫn là thách thức cần giám sát liên tục.

Takeaway: Tối ưu hóa thanh toán QR Pay giúp SMEs nâng cao trải nghiệm khách hàng và tăng hiệu quả kinh doanh, nhưng cần chuẩn bị kỹ thuật và quy trình vận hành chặt chẽ để đạt kết quả tối ưu.

Lingering resonance

Thanh toán QR Pay tại Agribank, BIDV, techcombank, Vietcombank và Vietinbank đều đơn giản, nhanh chóng và an toàn. Bạn chỉ cần mở app ngân hàng và quét mã là hoàn tất giao dịch.

Hãy thử ngay cách thanh toán QR Pay để trải nghiệm tiện lợi trong mọi giao dịch thanh toán hàng ngày. Đừng ngần ngại áp dụng để tiết kiệm thời gian và bảo mật thông tin.

Bạn cũng có thể tìm hiểu thêm về các giải pháp digital marketing giúp tăng trưởng kinh doanh cho SMEs. Các chủ đề liên quan như quảng cáo trực tuyến và tối ưu hóa chiến dịch sẽ rất hữu ích.

DPS.MEDIA luôn đồng hành cùng doanh nghiệp Việt nam trên hành trình chuyển đổi số. Hãy để lại ý kiến và chia sẻ trải nghiệm của bạn qua phần bình luận bên dưới!