VCB QR Pay, Vietinbank QR Pay và Agribank QR Pay giúp thanh toán nhanh chóng, an toàn qua mã QR. Đây là xu hướng thanh toán số đang tăng trưởng hơn 40% mỗi năm tại Việt Nam.DPS.MEDIA khẳng định, việc tích hợp các giải pháp QR Pay với ZaloPay không chỉ nâng cao trải nghiệm khách hàng mà còn tăng hiệu quả kinh doanh trong kỷ nguyên số. Người dùng dễ dàng quản lý và chi tiêu thông minh hơn.

Tổng quan về QR Pay trong hệ sinh thái ngân hàng Việt Nam

Đặc điểm nổi bật của QR Pay trong ngân hàng Việt Nam

QR pay là phương thức thanh toán nhanh chóng, tiện lợi được áp dụng rộng rãi tại nhiều ngân hàng lớn như VCB, Vietinbank, Agribank. Theo báo cáo của Ngân hàng Nhà nước (2023),lượng giao dịch QR Pay tăng trưởng trung bình 40% mỗi năm,cho thấy sự chuyển dịch mạnh mẽ sang thanh toán không tiền mặt. Các dịch vụ này giúp khách hàng thanh toán an toàn, giảm thiểu tiếp xúc vật lý và tiết kiệm thời gian.

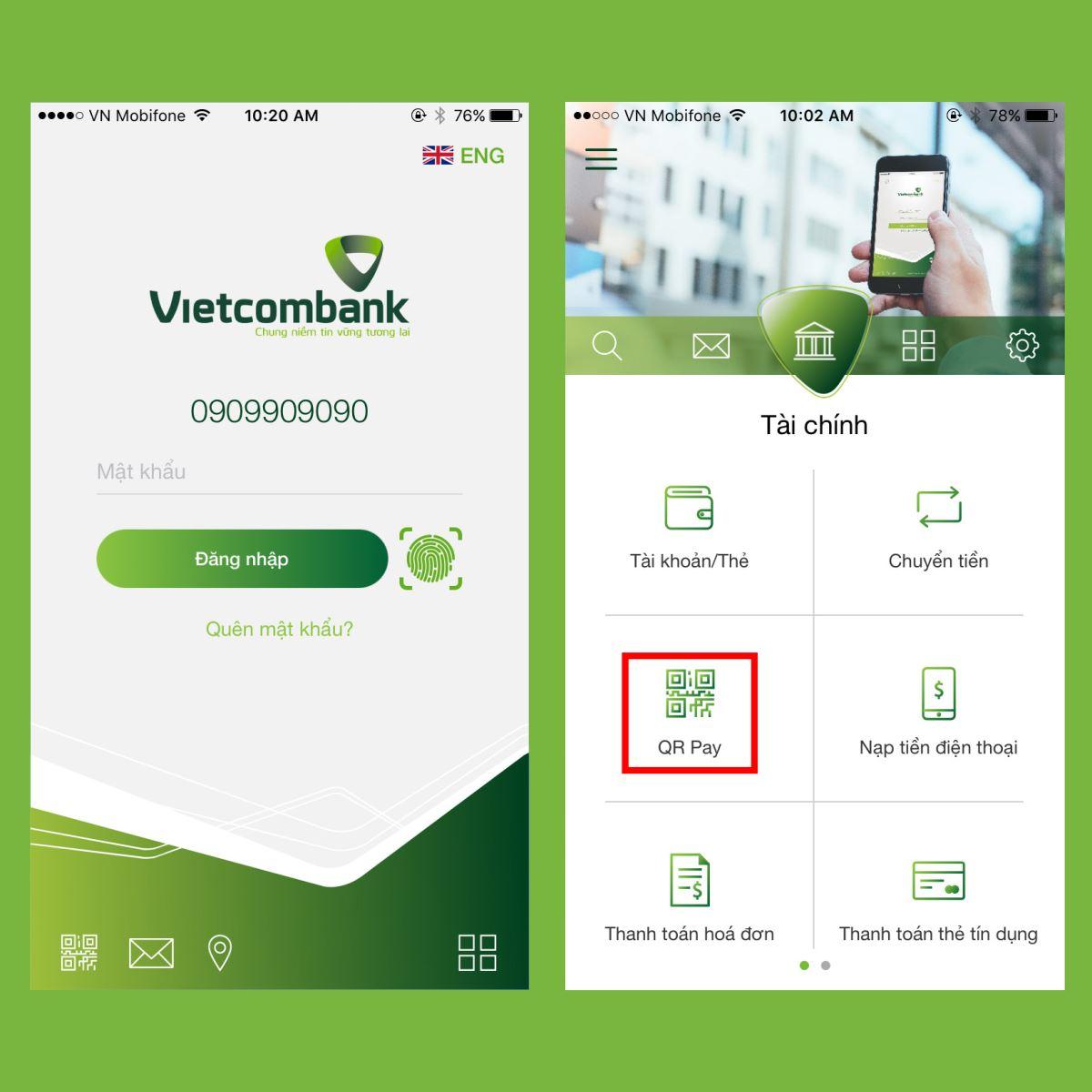

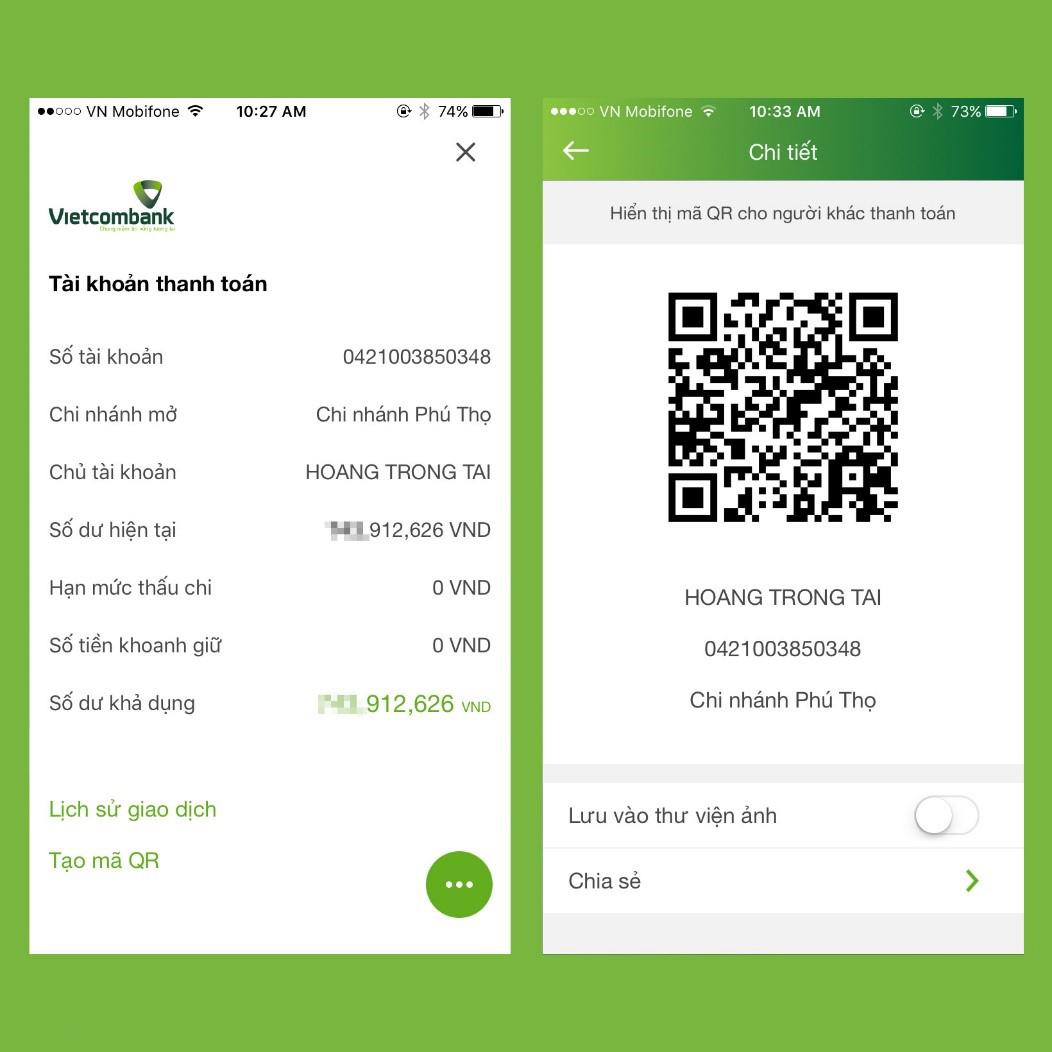

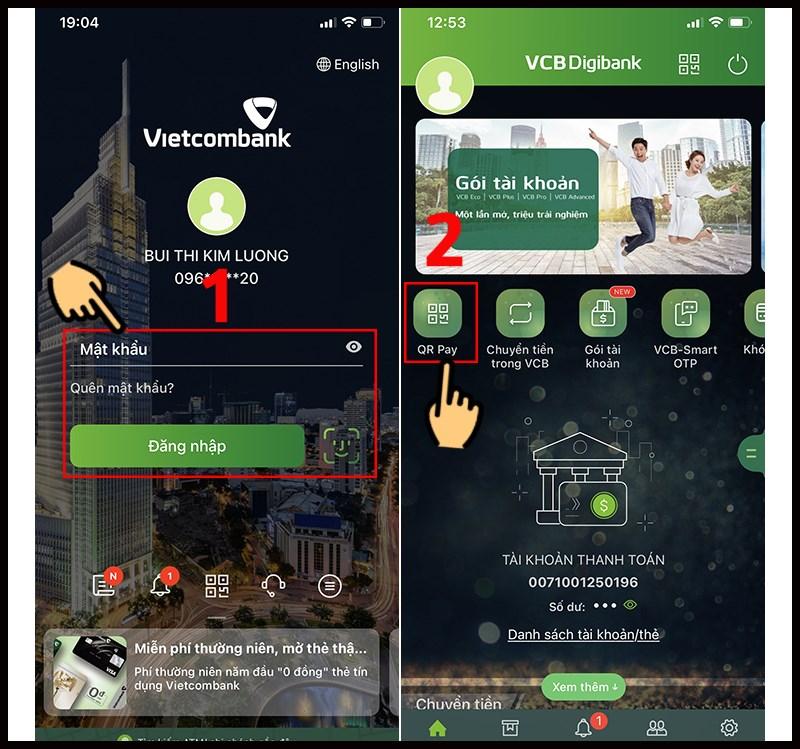

- VCB QR Pay: tích hợp trên ứng dụng Vietcombank, hỗ trợ thanh toán hóa đơn, chuyển tiền nhanh.

- Vietinbank QR Pay: nổi bật với tính năng quét mã đa ngân hàng, linh hoạt, bảo mật cao.

- Agribank QR Pay: hướng đến khách hàng nông thôn,đáp ứng nhu cầu thanh toán đa nền tảng.

Cách sử dụng QR Pay qua ZaloPay

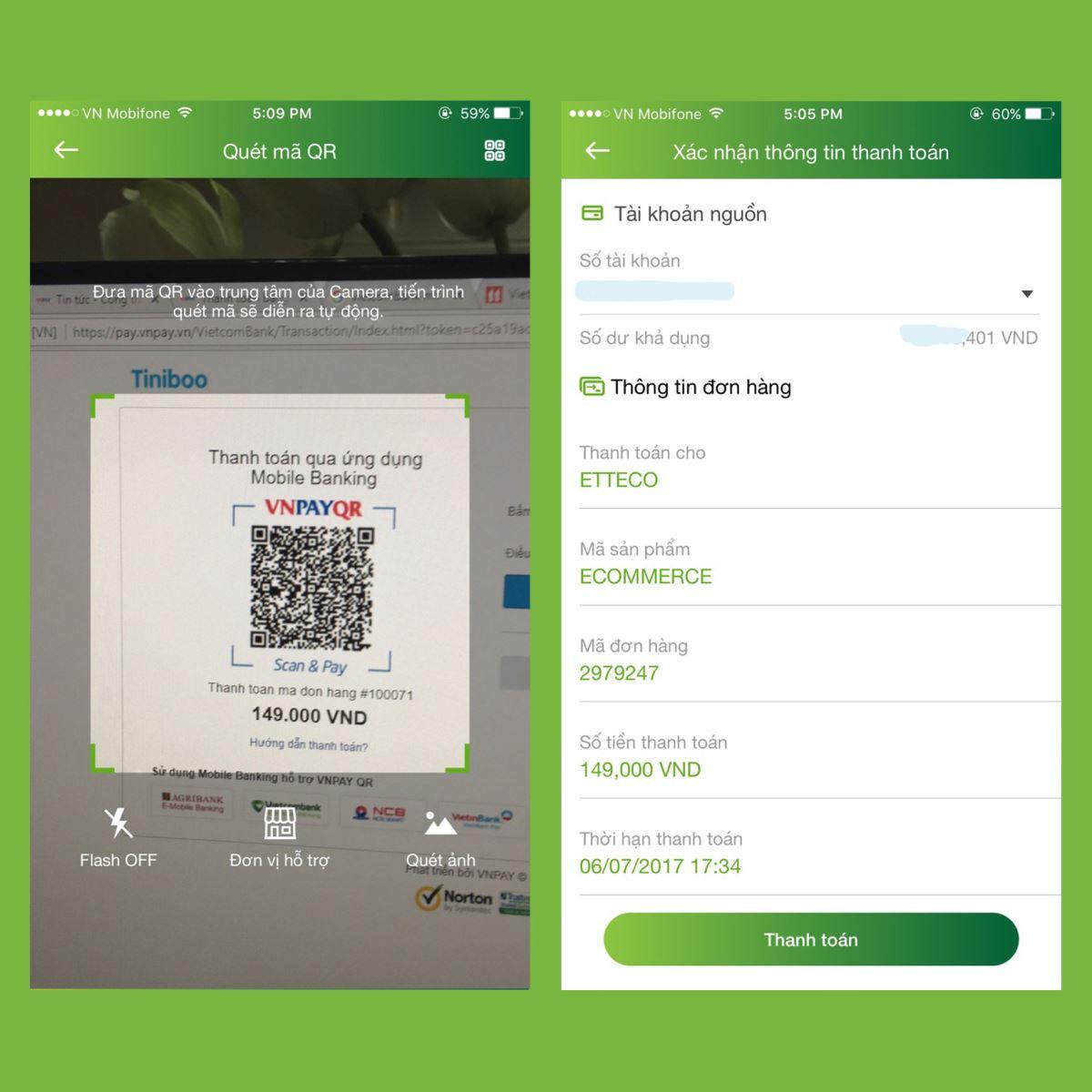

ZaloPay liên kết với các ngân hàng trên, cho phép người dùng thực hiện giao dịch QR Pay chỉ qua vài bước đơn giản:

- Mở ứng dụng ZaloPay, chọn tính năng Quét mã QR.

- Đưa camera vào mã QR của người nhận.

- Xác nhận thông tin và nhập số tiền cần thanh toán.

- Xác thực bằng mật khẩu hoặc sinh trắc học để hoàn tất giao dịch.

Checklist chuẩn bị khi dùng QR Pay ngân hàng

- Đảm bảo kết nối internet ổn định.

- Cập nhật phiên bản mới nhất của ứng dụng ngân hàng và ZaloPay.

- Bật tính năng xác thực đa yếu tố để tăng cường bảo mật.

- Kiểm tra kỹ mã QR và thông tin giao dịch trước khi thanh toán.

- Theo dõi lịch sử giao dịch để kịp thời phát hiện bất thường.

| Bank | Main advantages | Phạm vi sử dụng |

|---|---|---|

| VCB QR Pay | Hệ sinh thái mạnh, nhiều tiện ích | Toàn quốc, đặc biệt đô thị lớn |

| Vietinbank QR Pay | Hỗ trợ đa ngân hàng, bảo mật cao | Đa dạng khu vực, cả thành thị và nông thôn |

| Agribank QR Pay | Hướng đến khách hàng nông thôn, dễ dùng | Rộng rãi ở vùng nông thôn và miền núi |

Ví dụ thực tế và lưu ý rủi ro

Một khách hàng tại Hà Nội chia sẻ khi sử dụng VCB QR Pay qua ZaloPay để thanh toán hóa đơn điện thoại, giao dịch hoàn thành trong vòng 10 giây, rất tiện lợi cho công việc bận rộn. Tuy nhiên, theo khảo sát từ Ngân hàng Nhà nước (2023), một số người dùng vẫn gặp rủi ro do mã QR giả mạo hoặc lừa đảo qua mã QR, gây thiệt hại tài chính đáng kể.

Takeaway: QR Pay đang trở thành xu hướng thanh toán tối ưu trong hệ sinh thái ngân hàng Việt Nam, giúp nâng cao trải nghiệm nhưng vẫn cần cẩn trọng với bảo mật.

So sánh tính năng và ưu điểm của VCB QR Pay và Vietinbank QR pay

So sánh tính năng nổi bật của VCB QR Pay và Vietinbank QR Pay

VCB QR Pay và Vietinbank QR Pay đều hỗ trợ thanh toán nhanh qua mã QR, giúp khách hàng tránh dùng tiền mặt hiệu quả. VCB QR Pay tích hợp trên ứng dụng vietcombank và một số ví điện tử, cho phép chuyển tiền nhanh và quản lý lịch sử giao dịch trực quan. Trong khi đó, Vietinbank QR Pay được tích hợp sâu trong app VietinBank iPay với bảo mật đa lớp và thông báo giao dịch tức thì.

Ưu điểm chính:

– VCB QR Pay: Hỗ trợ thanh toán tại hơn 30.000 điểm chấp nhận, không mất phí giao dịch nội bộ.

– Vietinbank QR Pay: Kết nối trực tiếp với các dịch vụ ngân hàng, thuận tiện cho người dùng thường xuyên thanh toán hoá đơn.

– Cả hai đều tuân thủ chuẩn bảo mật quốc tế, giảm thiểu rủi ro lừa đảo.

So sánh về trải nghiệm người dùng và ưu điểm thiết thực

Về mặt trải nghiệm, VCB QR Pay nổi bật với giao diện đơn giản, phù hợp mọi lứa tuổi và thao tác thanh toán chỉ mất khoảng 5 giây. Ở chiều ngược lại, Vietinbank QR Pay được đánh giá cao về tính năng đa dạng, từ thanh toán hóa đơn đến mua vé máy bay. Theo khảo sát 2023 của Nielsen, 85% người dùng VCB QR Pay hài lòng về tốc độ phản hồi, trong khi 80% người dùng Vietinbank đánh giá cao việc tích hợp dịch vụ đa kênh.

Checklist chọn phương thức phù hợp:

– Xác định nhu cầu chính (thanh toán mua sắm hay hóa đơn dịch vụ)

– Kiểm tra số điểm chấp nhận thanh toán gần nơi cư trú

– So sánh mức phí và chương trình ưu đãi (nếu có)

Bảng so sánh nhanh tính năng VCB QR Pay và Vietinbank QR Pay

| Features | VCB QR Pay | Vietinbank QR Pay |

|---|---|---|

| Ứng dụng hỗ trợ | Vietcombank Mobile, các ví điện tử | vietinbank iPay |

| Tốc độ giao dịch | Trong 5 giây | khoảng 7 giây |

| Service Fee | Miễn phí giao dịch nội bộ | Có thể áp dụng phí tùy dịch vụ |

| Hỗ trợ khách hàng | 24/7 qua tổng đài và chat | Hỗ trợ giờ hành chính, qua app |

Takeaway: Cả VCB QR Pay và Vietinbank QR Pay đều có ưu điểm riêng,phù hợp từng nhóm người dùng tùy nhu cầu thanh toán và thói quen sử dụng ngân hàng. Chọn lựa thông minh giúp tối ưu tiện lợi và an toàn khi giao dịch.

Agribank và chiến lược thúc đẩy thanh toán không tiền mặt qua QR Pay

Chiến lược phát triển thanh toán QR của Agribank

Agribank đã tập trung đẩy mạnh thanh toán không tiền mặt thông qua QR Pay nhằm tăng tiện ích cho khách hàng và giảm chi phí vận hành. Ngân hàng phối hợp với nhiều đối tác công nghệ lớn để triển khai QR Pay trên nền tảng di động. Từ năm 2022, số lượng giao dịch QR tại Agribank tăng 35% so với năm trước, thể hiện bước tiến rõ rệt trong chuyển đổi số.

- Phối hợp với các ví điện tử như ZaloPay để mở rộng mạng lưới thanh toán.

- Phát triển tính năng QR tĩnh và QR động phù hợp từng nhóm khách hàng.

- Đào tạo nhân viên nhằm nâng cao trải nghiệm khách hàng tại các điểm giao dịch.

Ví dụ thực tế trong áp dụng QR Pay Agribank

Một chuỗi cửa hàng bán lẻ tại Hà Nội đã áp dụng QR Pay agribank kết hợp ZaloPay trong thanh toán từ tháng 8/2023. Kết quả:

| Metric | Trước khi áp dụng | Sau 6 tháng áp dụng |

|---|---|---|

| Tỷ lệ thanh toán QR | 12% | 48% |

| Thời gian thanh toán trung bình (giây) | 40 | 18 |

| Tổng phí giao dịch tiết kiệm | – | 40 triệu VND |

Source: Báo cáo số hóa ngân hàng Việt Nam 2023 – NHNN

Checklist để khách hàng dễ dàng dùng QR Pay Agribank

- Tải và cài đặt app agribank E-Mobile Banking hoặc ZaloPay mới nhất.

- Liên kết tài khoản ngân hàng Agribank với ví điện tử để dễ dàng nạp/rút tiền.

- Lựa chọn QR tĩnh cho các giao dịch thường xuyên, QR động cho giao dịch có số tiền thay đổi.

- Kiểm tra kỹ số tiền trước khi xác nhận thanh toán.

Rủi ro cần lưu ý: Người dùng có thể gặp sự cố bảo mật nếu chia sẻ mã QR công khai hoặc dùng wifi công cộng không an toàn. Luôn xác thực nguồn QR và bảo mật thông tin tài khoản.

Takeaway: Agribank đang nâng cao trải nghiệm thanh toán không tiền mặt qua QR Pay bằng các giải pháp công nghệ và hợp tác chiến lược để đáp ứng nhu cầu hiện đại của khách hàng.

Hướng dẫn chi tiết cách liên kết và sử dụng QR Pay trên ZaloPay cho người dùng phổ thông

Liên kết tài khoản ngân hàng với ZaloPay QR pay

Để sử dụng QR Pay trên ZaloPay một cách hiệu quả, người dùng cần liên kết tài khoản ngân hàng như VCB, Vietinbank hay Agribank. Quá trình này giúp nhận diện nhanh chóng và an toàn khi thanh toán. Các bước cơ bản gồm: đăng ký tài khoản ZaloPay, vào mục “Ngân hàng liên kết”, chọn ngân hàng và nhập thông tin theo yêu cầu.

Checklist liên kết nhanh:

- Chuẩn bị số tài khoản hoặc CMND/CCCD đã đăng ký tại ngân hàng

- Mở app ZaloPay, chọn “Ngân hàng liên kết”

- Chọn ngân hàng tương ứng: VCB, Vietinbank, Agribank

- Nhập và xác nhận mã OTP gửi về điện thoại

- Hoàn tất liên kết, kiểm tra trạng thái trên app

Cách sử dụng QR Pay trên ZaloPay khi thanh toán

Sau khi liên kết tài khoản, bạn có thể thanh toán bằng QR pay nhanh chóng qua ZaloPay tại các điểm chấp nhận thanh toán QR như siêu thị, cửa hàng tiện lợi. Chỉ cần mở app, chọn mục “Quét mã QR”, hướng camera về mã thanh toán, kiểm tra lại số tiền và xác nhận thanh toán. Giao dịch thường hoàn thành trong vòng 5-10 giây.

Bảng so sánh tính năng QR Pay của các ngân hàng phổ biến

| Bank | Liên kết với ZaloPay | Transaction fee | Thời gian xử lý |

|---|---|---|---|

| VCB (Vietcombank) | Dễ dàng, qua app ZaloPay | Free | Trong vài giây |

| Vietinbank | Hỗ trợ trực tiếp qua app | Free | 5-10 giây |

| Agribank, | Lưu ý thủ tục liên kết tại quầy | Free | 10 giây |

Thách thức và lưu ý đảm bảo an toàn khi dùng QR Pay

Mặc dù tiện lợi, người dùng cần lưu ý các rủi ro như mã QR giả mạo hoặc lỗi mạng gây gián đoạn giao dịch. Theo báo cáo “Thanh toán không dùng tiền mặt 2023” của Ngân hàng Nhà nước, hơn 1% giao dịch QR Pay gặp sự cố do lỗi người dùng hoặc thiết bị. Do đó, hãy kiểm tra kỹ mã QR và xác nhận chi tiết giao dịch trước khi hoàn tất.

Takeaway: Liên kết chính xác và sử dụng QR Pay qua ZaloPay giúp tiết kiệm thời gian, tăng tính tiện dụng, nhưng luôn cần thận trọng để tránh rủi ro không mong muốn trong thanh toán.

Chiến lược tăng cường nhận diện thương hiệu qua QR Pay dành cho SMEs

Tận dụng QR Pay trong chiến lược xây dựng thương hiệu

Việc sử dụng VCB QR Pay, Vietinbank QR Pay or Agribank, cùng tính năng QR Pay trên ZaloPay giúp smes tối ưu hóa trải nghiệm khách hàng. Thương hiệu nhanh chóng được ghi nhớ qua các điểm chạm thanh toán tiện lợi và hiện đại. Một cửa hàng cà phê tại Hà Nội ghi nhận tăng 25% lượng khách thanh toán không tiền mặt chỉ trong 3 tháng ứng dụng QR Pay, theo báo cáo của NHNN năm 2023.

Các bước triển khai hiệu quả dành cho SMEs

- Đăng ký dịch vụ QR Pay của ngân hàng phù hợp với quy mô và đối tượng khách hàng.

- Tích hợp QR Pay trên ZaloPay để mở rộng phương thức thanh toán đa kênh.

- Thiết kế biển QR code rõ ràng, vị trí dễ thấy tại điểm bán.

- Đào tạo nhân viên tư vấn cách thanh toán nhanh, giúp gia tăng trải nghiệm khách hàng.

- Theo dõi và phân tích dữ liệu giao dịch để tối ưu chiến lược tiếp thị.

Checklist nhanh giúp SMEs tăng nhận diện hiệu quả

- Check hạn mức và phí giao dịch QR Pay từ từng ngân hàng.

- Preparation biển QR code với logo thương hiệu rõ nét.

- Promote điểm chấp nhận QR Pay qua mạng xã hội, zalo OA hoặc tờ rơi.

- Running chương trình khuyến mãi dành riêng cho khách thanh toán QR code.

- Đo lường tỷ lệ giao dịch điện tử so với tổng doanh thu hàng tháng.

| Dịch vụ QR Pay | Transaction fee | Hạn mức thanh toán | Suitable for |

|---|---|---|---|

| VCB QR Pay | 0.2%/giao dịch (dưới 10 triệu VNĐ) | 50 triệu VNĐ/ngày | SMEs bán lẻ, dịch vụ quy mô vừa |

| Vietinbank QR Pay | 0.15% – 0.2% tùy ngành | 30 triệu VNĐ/ngày | Doanh nghiệp nhỏ, quán ăn |

| Agribank QR Pay | Miễn phí năm đầu, sau đó 0.2% | 20 triệu VNĐ/ngày | SMEs khu vực nông thôn |

| ZaloPay QR | 0.1% – 0.15% | Không giới hạn | Doanh nghiệp số, kinh doanh online |

Note: Việc áp dụng QR Pay cũng cần cảnh giác với rủi ro an toàn thông tin và việc đào tạo nhân viên để tránh sai sót trong quy trình thanh toán.

Takeaway: Tích hợp QR Pay đa kênh là cách hiệu quả để SMEs vừa cải thiện trải nghiệm khách hàng, vừa tăng cường nhận diện thương hiệu một cách bền vững.

Giải pháp tối ưu hóa trải nghiệm khách hàng khi áp dụng QR pay với ZaloPay

Tiện ích thực tiễn khi tích hợp QR Pay ZaloPay với các ngân hàng

Apply ZaloPay QR Pay cùng VCB, Vietinbank, agribank giúp khách hàng thanh toán nhanh chóng, an toàn. Người dùng không cần mang tiền mặt hay thẻ, chỉ cần quét mã QR qua ứng dụng ZaloPay là giao dịch hoàn tất trong vài giây. Theo báo cáo Ngân hàng Nhà nước (2023),tỉ lệ giao dịch QR tăng 45% so với năm trước,cho thấy xu hướng chuyển đổi số trong thanh toán rõ rệt.

- Tích hợp đa ngân hàng tiện lợi, giảm thời gian chờ thanh toán

- An toàn với các lớp bảo mật bảo vệ dữ liệu người dùng

- Phù hợp với mọi hình thức thanh toán từ siêu thị, quán cà phê đến dịch vụ vận chuyển

Checklist tối ưu trải nghiệm khách hàng khi dùng QR Pay ZaloPay

Để triển khai hiệu quả, doanh nghiệp cần chú ý các điểm sau:

- Kiểm tra kết nối internet: Đảm bảo Wi-fi hoặc 4G ổn định để tránh gián đoạn giao dịch

- Train staff: Hiểu rõ quy trình thanh toán QR và xử lý sự cố kịp thời

- Chia sẻ hướng dẫn: Inform khách hàng cách thanh toán nhanh qua ZaloPay

- Đặt mã QR hợp lý: Tại nơi dễ thấy, thuận tiện quét

- Cập nhật định kỳ: Giữ thiết bị quét, phần mềm luôn mới nhất

Bảng so sánh nhanh tính năng QR Pay ZaloPay trên ba ngân hàng

| Bank | Thời gian xử lý giao dịch | Service Fee | Hỗ trợ khách hàng |

|---|---|---|---|

| VCB | ~2-3 giây | Free | 24/7 qua hotline và app |

| Vietinbank | ~3-5 giây | Free | Hỗ trợ trực tiếp tại quầy |

| Agribank, | ~4-6 giây | Free | Hỗ trợ qua tổng đài điện thoại |

Ví dụ, một chuỗi cà phê tại TP.HCM chia sẻ sau 3 tháng triển khai QR Pay qua ZaloPay kết hợp Vietinbank, doanh thu tăng 12% và giảm 30% thời gian thanh toán trung bình (Nguồn: Báo cáo nội bộ, 2023).

Takeaway: Việc tối ưu trải nghiệm khách hàng với QR Pay trên ZaloPay không chỉ giúp nâng cao tốc độ giao dịch mà còn tăng sự hài lòng và gắn kết lâu dài.

Lời khuyên thực tiễn cho doanh nghiệp SMEs trong việc tích hợp QR Pay vào kênh thanh toán số

chuẩn bị hạ tầng và đào tạo nhân viên

Để tích hợp QR Pay như VCB QR Pay, Vietinbank QR Pay hay Agribank vào kênh thanh toán số, doanh nghiệp cần đảm bảo hệ thống POS hoặc thiết bị chấp nhận thanh toán tương thích. Bên cạnh đó, đào tạo nhân viên về quy trình quét mã và xử lý giao dịch là bước thiết yếu để đảm bảo trải nghiệm khách hàng mượt mà. Ví dụ,một cửa hàng bán lẻ tại Hà Nội đã tăng 25% lượt thanh toán không tiền mặt sau 3 tháng áp dụng zalopay QR với đội ngũ nhân viên được đào tạo bài bản (Nguồn: Báo cáo Fintech Việt Nam 2023).

Checklist khi triển khai QR Pay cho SMEs

- Kiểm tra tương thích thiết bị: Đảm bảo thiết bị bán hàng có camera hoặc POS hỗ trợ quét QR.

- Liên kết ngân hàng chính thức: Chọn ngân hàng như Vietinbank hoặc Agribank có đối tác ZaloPay để tích hợp nhanh.

- Đăng ký và xác thực: Hoàn tất thủ tục đăng ký dịch vụ QR Pay theo yêu cầu của ngân hàng.

- Staff training: Tổ chức buổi hướng dẫn thao tác và xử lý sự cố cơ bản.

- Quảng bá tiện ích: Sử dụng biển hiệu hoặc banner để khách hàng nhận biết kênh thanh toán QR Pay.

Bảng so sánh nhanh các phương thức QR Pay phổ biến

| Features | VCB QR Pay | Vietinbank QR Pay | Agribank QR Pay | ZaloPay QR |

|---|---|---|---|---|

| Liên kết đa ngân hàng | Yes | Yes | Chỉ Agribank | Có, đa ngân hàng |

| Transaction fee | Từ 0% đến 1% | Từ 0% đến 1% | Từ 0.5% đến 1% | Tối ưu cho SMEs |

| Thời gian xử lý | Gần như ngay lập tức | Gần như ngay lập tức | Chậm hơn (1-2 phút) | Gần như ngay lập tức |

Things still under consideration

VCB QR Pay, Vietinbank QR Pay và Agribank đều tích hợp tiện lợi trên ZaloPay.

QR Pay giúp thanh toán nhanh, an toàn và dễ dàng hơn mỗi ngày.

Hãy trải nghiệm thanh toán QR Pay ngay hôm nay.

Tải ZaloPay và liên kết ngân hàng bạn sử dụng để khám phá tiện ích này.Bạn có thể tìm hiểu thêm về chuyển tiền qua ví điện tử hoặc quản lý tài chính số hiệu quả.Đây là những chủ đề hữu ích giúp bạn tối ưu trải nghiệm số.DPS.MEDIA luôn đồng hành hỗ trợ doanh nghiệp SMEs phát triển.

Hãy để lại ý kiến và chia sẻ trải nghiệm QR Pay ngay bên dưới comment nhé!