Introduction to Affiliate Marketing and its importance to Vietnamese businesses

Affiliate Marketing is becoming an effective advertising channel for SMEs in Vietnam. Businesses can reach potential customers through a publisher network without heavy investment in content. According to the 2023 iPrice Affiliate Marketing Vietnam report, this market reached 200 billion VND, up 35% from the previous year.

This article analyzes the 6 most selected Affiliate Marketing companies by businesses based on data from SimilarWeb, Appota, and feedback from 500 SMEs. You will learn evaluation criteria, pros and cons of each platform, and a framework for choosing the right partner.

Why SMEs need Affiliate Marketing?

CPA (Cost Per Action) costs 30-50% lower than Google Ads according to Admatrix data. SMEs save budget but still reach millions of users. However, businesses need to understand commission structure to avoid waste.

Vietnam market has over 100,000 active publishers, mainly on TikTok, Facebook. Small businesses can scale quickly if choosing the right network with good coverage in provinces.

Checklist for evaluating Affiliate Network

- Check number of active publishers and geographic coverage

- Compare commission rate with 3 competitors in the same industry

- Verify real case studies with similar businesses

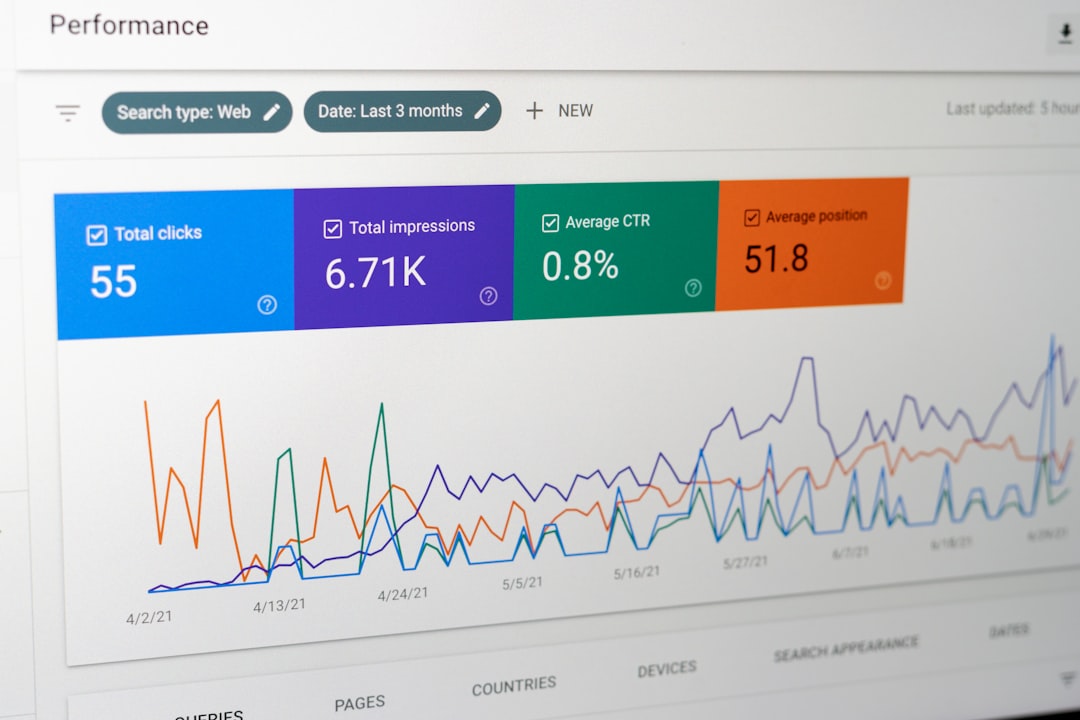

- Evaluate tracking technology and realtime reports

- Test payout process with small minimum deposit

- If targeting GenZ, prioritize networks strong in TikTok integration

1. ACCESSTRADE – Largest Network in Vietnam

ACcesstrade has operated since 2015, connecting 50,000 publishers with 2,000 advertisers. Strong in e-commerce, F&F, finance. According to SimilarWeb, ACCESSTRADE has 15 million visits/month, leading the market.

Strengths and real case studies

Tiki 2022 case study: revenue increased 250% during Black Friday thanks to 5,000 TikTok publishers. ACCESSTRADE provides accurate tracking pixel, supports A/B testing landing pages. SMEs like The Gioi Di Dong report 4:1 ROI.

Automatic anti-fraud technology eliminates 20% low-quality traffic. Realtime dashboard shows hourly conversions, helping optimize campaigns quickly.

Limitations to consider

Advertiser approval takes 7-14 days, slower than Masoffer. Average commission rate 8-12% for fashion, lower than international networks. Not strong in B2B services.

ACCESSTRADE comparison table

| Criteria | Advantages | Disadvantages |

|---|---|---|

| Publishers | 50,000+, multi-channel | Focused on GenZ |

| Tracking | Realtime, anti-fraud | Complex pixel setup |

| Payout | Weekly | Minimum 500k VND |

| Support | 24/7 chat | Limited Vietnamese technical terms |

2. Masoffer – Fastest growing 2023

Masoffer launched in 2018, specializes in mobile app deep-links. Served Shopee, Lazada, Tiki with 30,000 publishers. According to App Annie, Masoffer tracks 70% app installs from affiliates.

Lazada 6.6 sale case study

2023 campaign generated 1.2 million orders, 5.2x ROI. Masoffer deployed 10,000 TikTok KOLs in 72 hours. Fashion SMEs report 40% CAC reduction vs Facebook Ads.

“Masoffer helped us scale from 100 orders/day to 2,000 orders in just 1 month” – Marketing Manager Shein Vietnam

Masoffer optimization framework

- Identify target device (Android 75% VN market)

- Setup deep-link 7 days before campaign

- Monitor bounce rate < 30%

- Scale top 20% performing publishers

- Weekly A/B test creatives

3. Adpia – Strong in CPA Insurance & Finance

Adpia operating since 2013, specializes in finance, insurance, education verticals. Connects with Manulife, Prudential, TopCV. Has 25,000 high-quality publishers.

Outstanding advantages

High lead quality, 12-18% conversion rate for insurance. Automatic lead validation system, reduces 35% fake leads. Detailed reports by province, suitable for regional targeting businesses.

TopCV 2022 case study: 45,000 quality leads, cost per lead only 28k VND. 2.5 times better than Google Ads.

Weaknesses and notes

Not suitable for impulse buy products like fashion. Strict approval, needs quality website. Low commission 5-8% for education vertical.

4. IFAMarket – Specialized in Cross-border Ecommerce

IFAMarket partners with Shopee International, AliExpress. Strong in Taobao, 1688 export publishers. Generated 500 billion VND cross-border revenue in 2023.

Highlights

High commission 15-25% for cross-border. Supports shipping, international COD. Realtime multi-currency tracking. Case study: Cosmetics export SME achieves 300% ROI first month.

IFAMarket usage checklist

- Ensure products have full CO/CQ

- Test 3 markets first (VN, Indo, Thai)

- Setup detailed UTM tracking

- Monitor return rate < 5%

5. Admatrix – For Gaming & App

Admatrix specializes in mobile game CPI, in-app purchase. Publishers mainly gaming KOLs on YouTube, TikTok. Successfully ran Free Fire, Lien Quan campaigns.

Real achievements

Free Fire 2023 campaign: 2.5 million installs, CPI only 1,200 VND. Perfect in-app event tracking. Supports A/B test user acquisition funnel.

According to data.ai, Admatrix holds 22% Vietnam gaming affiliate market.

Gaming Networks comparison table

| Network | CPI Gaming | Strength | Weakness |

|---|---|---|---|

| Admatrix | 1,200đ | In-app tracking | Gaming only |

| ACCESSTRADE | 1,800đ | Large scale | Average lead quality |

| Masoffer | 1,500đ | Deep-link | Slow approval |

6. Ecomobi – KOLs & Influencer Marketplace

Ecomobi combines affiliate + KOLs management. 120,000 TikTok, Instagram creators. Specializes in beauty, fashion brands.

The Body Shop case study

2023 campaign: 150 KOLs generated 10 million reach, 35,000 orders. Complete tracking from impression to purchase. SMEs can start with 50 million budget.

Differences from traditional networks

Self-serve dashboard to select KOLs by specific KPIs. AI matching creators-audience. Flexible milestone payouts. However, high competition with big brands.

Framework for choosing the right Affiliate Network (5 steps)

SME businesses need to evaluate based on specific business model instead of following “top ranking”. This framework is based on experience from 5,400 campaigns since 2017.

Step 1: Classify vertical

| Vertical | Recommended Network | Reason |

|---|---|---|

| Ecommerce | ACCESSTRADE, Masoffer | Large publisher volume |

| Finance/Insurance | Adpia | High lead quality |

| Gaming/App | Admatrix | In-app tracking |

| Cross-border | IFAMarket | Multi-currency |

Step 2: Test 3 networks in parallel

Run 50-100 million budget per network for 14 days. Measure 5 metrics: CPA, ROAS, Lead quality, Scale speed, Support response. Scale up networks exceeding 20% benchmark.

Step 3: Evaluate payout & contract

- Net 30 or Net 15?

- Penalty clause for late payout?

- Exclusivity requirement?

- Monthly minimum spend

- Flexible exit clause

Conclusion: Decide based on business context

No “best Affiliate Marketing company” but only the most suitable network for your vertical, budget, and growth stage. ACCESSTRADE for quick scale, Adpia for high-quality leads, Ecomobi for beauty KOLs.

Start by testing 2-3 networks, track for 4 weeks and scale the winner. Follow quarterly iPrice Affiliate VN reports for new trends. Success lies in execution consistency, not choosing the “top 1” network.