Executive Summary

This report provides an in-depth analysis of the retail and distribution market in Vietnam for the period 2024–2026, with a vision to 2030. Based on the latest macroeconomic data from the General Statistics Office (GSO), World Bank (WB), and international financial institutions, we forecast a new dynamic growth cycle with many challenges.

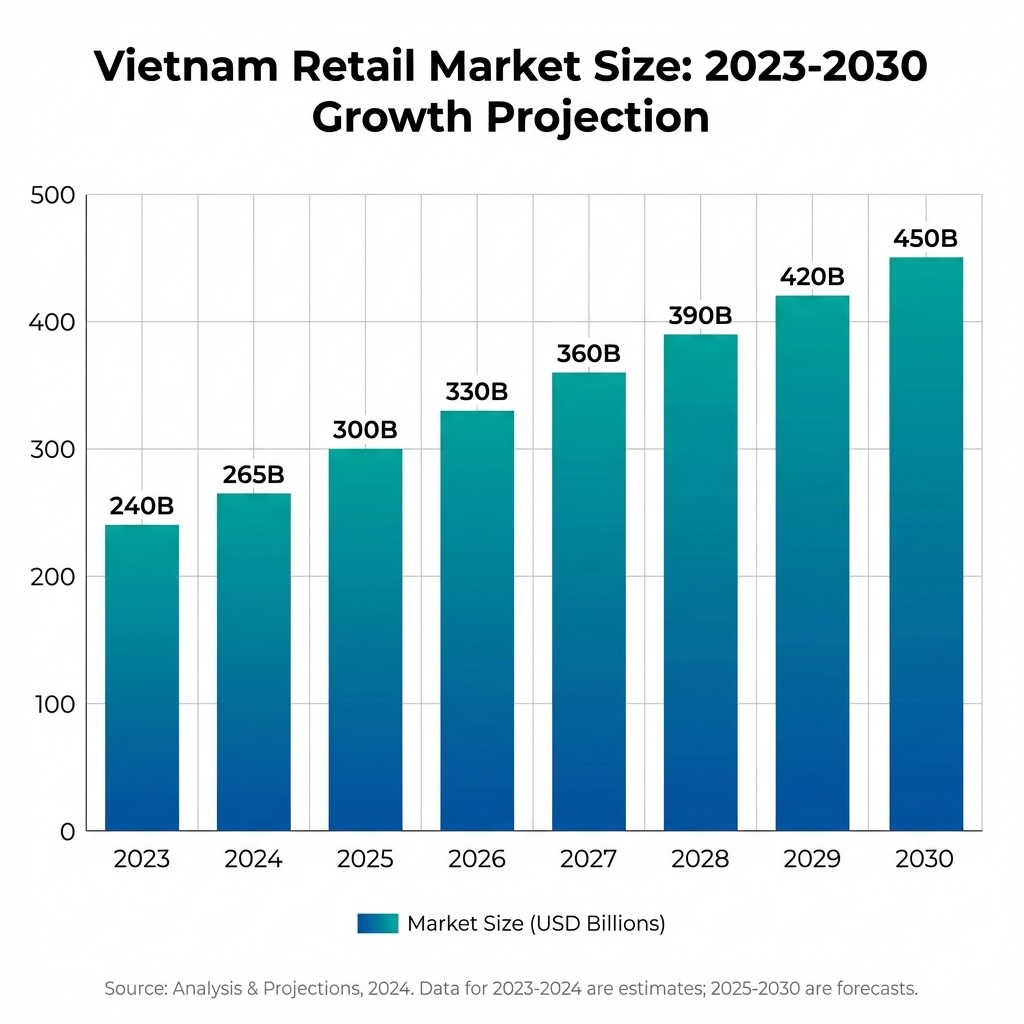

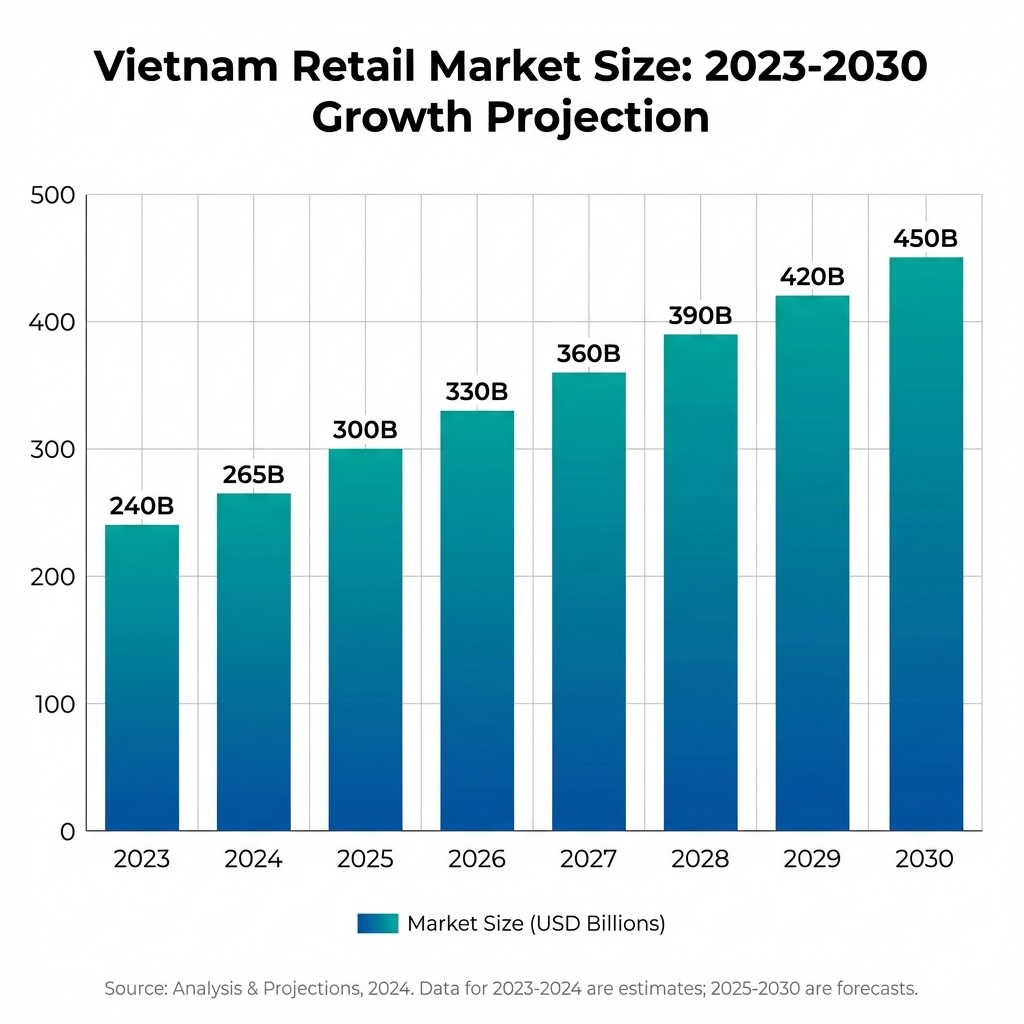

Vietnam is at the threshold of a comprehensive retail structure transformation, driven by the rise of the middle class, urbanization, and the digital revolution. The retail market scale is expected to reach 300 billion USD by 2025 and head towards 450 billion USD by 2030.

Part 1: Macroeconomic Context & Outlook 2025-2026

1.1. GDP Growth & Macro Stability

Vietnam's economy has demonstrated impressive resilience. According to forecasts from the World Bank and ADB, Vietnam's real GDP growth will reach 6.5% – 6.8% in 2025 and maintain growth momentum at around 6.5% in 2026. This is one of the highest growth rates in Southeast Asia, creating a solid foundation for domestic purchasing power.

Inflation is well-controlled below 4% (forecast 3.5% – 3.8% for 2025-2026), ensuring real income of the population is not eroded. Stable exchange rates and strong FDI inflows into manufacturing and retail are positive signals indicating international investor confidence.

1.2. Rise of the Middle Class & Purchasing Power

The biggest driver of Vietnam's retail market is demographics. According to BMI (Fitch Solutions), household spending is expected to grow in real terms 6.0% in 2025 and accelerate to 7.2% in 2026. The expansion of the middle class with increasingly high disposable income is completely changing consumer behavior from “enough to eat, enough to wear” to “eat well, dress beautifully” and high-quality living experiences.

Part 2: In-Depth Retail Market Analysis (Retail Market Analysis)

The Vietnamese retail market is not only growing in volume but also undergoing a strong shift in quality. The competition between traditional channels (General Trade – GT) and modern channels (Modern Trade – MT) is entering a fierce phase, with advantages gradually tilting towards technology-integrated modern models.

2.1. Scale & Growth Rate

Aggregate data shows the retail market size (including goods and services) is estimated to reach 265 – 269 billion USD in 2024. With a projected compound annual growth rate (CAGR) of {"translations":[{"9% – 12%"}]} during 2025-2030, the market will quickly surpass the 300 billion USD mark.

The chart below forecasts market size growth to 2030:

2.2. Market Structure by Sector (Sector Analysis)

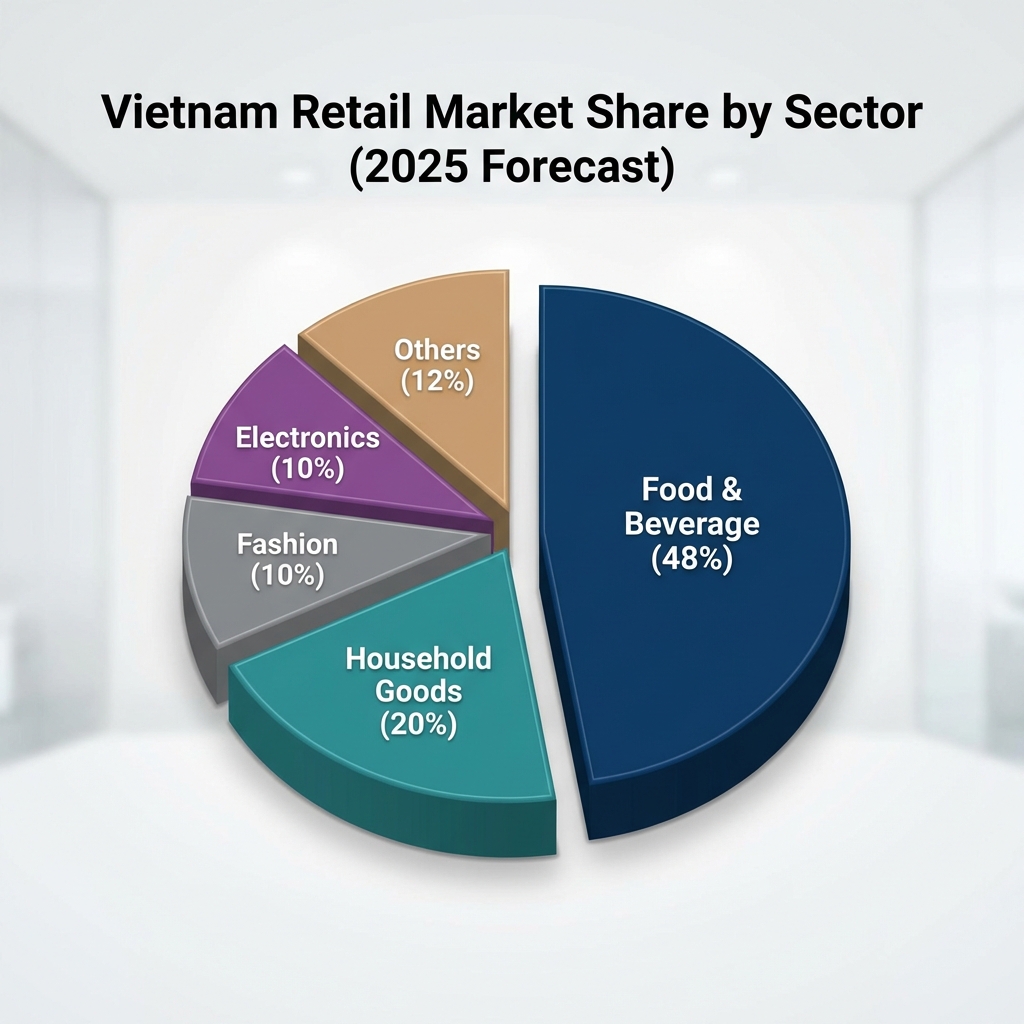

The Vietnamese retail industry is driven by two main pillars: Food & Beverage (F&B) and Household Goods.

Food & Beverage Sector (F&B) – “Backbone” of Retail

Accounting for an overwhelming proportion of about 48% total retail revenue, F&B is the most attractive but also the most brutal sector.

- Premiumization Trend (Premiumization): Consumers are willing to pay 20-30% higher prices for organic products, GlobalGAP certified or with reputable imported origins (US, Australia, Japan, Europe).

- Ready-to-Eat Processed Foods (RTE – Ready to Eat): With the hectic urban lifestyle, demand for convenient, nutritious meals is exploding at convenience store chains (CVS) like Circle K, FamilyMart, GS25.

Household Goods & Personal Care Sector

Forecasted double-digit growth (around 13.6% in 2025), this is the rising star. The driving force comes from rapid urbanization and demand to equip new apartment buildings. Smart home appliances (Smart Home) and premium personal care products are becoming the new living standard for young Vietnamese families.

The chart below illustrates the market share structure of industry groups in 2025:

Part 3: Supply Chain Revolution & Logistics (Supply Chain Revolution)

One of the biggest bottlenecks in Vietnamese retail is high logistics costs (accounting for about 16% of GDP). However, the 2025-2026 period will witness a revolution to reduce these costs to the target level 11-12%.

3.1. Green Logistics (Green Logistics)

Sustainable development is no longer a slogan but a market imperative. Major retailers like The Gioi Di Dong, Aeon, Central Retail are pioneering the use of electric delivery fleets (EV), recycled packaging, and optimized transportation routes to reduce carbon emissions (Net Zero Roadmap).

3.2. Smart Warehousing Infrastructure (Smart Warehousing)

The e-commerce boom requires highly automated Fulfillment warehouse systems. Investment in Robotics technology, AS/RS (Automated Storage and Retrieval Systems), and IoT in warehouse management is becoming the mainstream trend to shorten last-mile delivery time to under 2 hours or even 30 minutes.

3.3. Cold Chain (Cold Chain)

For the food industry, perfecting the cold chain supply is a vital factor to reduce agricultural product spoilage rates (currently still high at 20-25%) and ensure food hygiene and safety. Investment in cold storage is forecasted to grow strongly, opening opportunities for specialized logistics investors.

Part 4: Portrait of Vietnamese Consumers 2026

Understanding consumers is the key to success. The portrait of Vietnamese consumers in 2026 is sketched through 3 main characteristics:

- Gen Z & Gen Alpha – The Leading Generation: This group, born in the digital age (Digital Natives), has value-based consumption trends (Value-based system). They care more about sustainability, brand ethics, and personalized experiences than traditional brand loyalty.

- New Rural Consumers: With widespread internet infrastructure and logistics reaching communes, the consumption gap between urban and rural areas is narrowing rapidly. Rural areas are becoming a “blue ocean” for modern retailers as urban markets gradually saturate.

- Phygital Consumption: Combining physical (Physical) and digital (Digital). Customers search for information online, experience in offline stores, and can order via app. The shopping journey is no longer a straight line.

Summary of strategic trends shaping the market:

Part 5: Strategic Recommendations & Forecasts (Strategic Recommendations)

Based on the above analysis, we provide strategic recommendations for retail and distribution businesses in Vietnam for the 2025-2030 period:

5.1. “True” Omnichannel Strategy (True Omnichannel)

Businesses need to eliminate the boundary between online and offline. Customer data must be synchronized (Single Customer View) to personalize every touchpoint. Investment in CDP (Customer Data Platform) is mandatory.

5.2. Conquering the Rural Market (Rural Expansion)

Learning from WinCommerce's successful model, businesses need to design lean store models, product assortments suitable for local spending power and consumer culture to penetrate the vast rural market (accounting for 60% of the population).

5.3. Big Data & AI Applications (Data-Driven Decision Making)

Use AI for more accurate demand forecasting, reduce inventory and optimize promotions. AI will also play a crucial role in automating customer service (Chatbots, Virtual Assistants).

5.4. Partnerships & M&A (Mergers and Acquisitions)

The market will witness a strong wave of M&A as foreign corporations (Thailand, Korea, Japan) want to quickly expand market share and domestic businesses need resources to compete. Strategic cooperation is the shortest path to leverage each other's strengths.

Conclusion

The Vietnamese retail market in 2026 is a colorful picture with bright dominant tones. Opportunities are huge for businesses with long-term vision, committed to investing in technology and sustainable development. However, competitive pressure will also eliminate outdated business models that are slow to innovate.

Vietnam is no longer a potential market that “will” develop, but a market that “must” be present in the strategy of every regional and global retail corporation.

Data sources: General Statistics Office (GSO), World Bank (WB), Asian Development Bank (ADB), Fitch Solutions (BMI), retail industry reports 2024-2025.