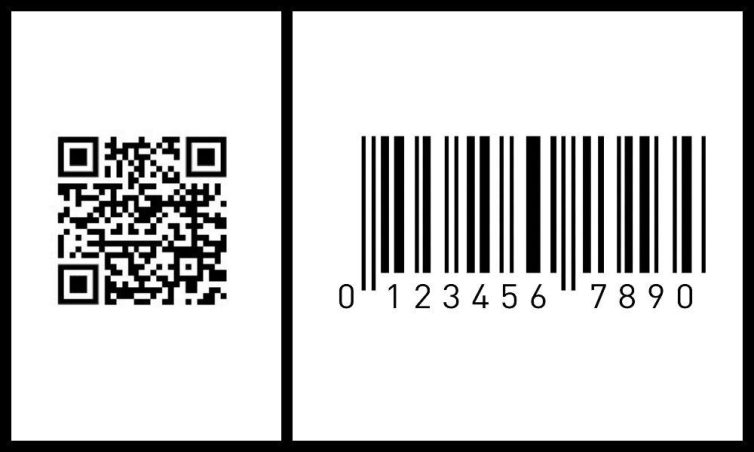

Techcombank QR Code payment enables fast, secure, and convenient transactions in just a few seconds. 85% digital payment users in Vietnam choose this method for its simplicity and popularity.

According to statistics, QR Code payments grow more than 120% every year, especially suitable for MSME businesses. DPS.MEDIA Consulted on many projects applying QR Code, proving effectiveness in attracting customers and optimizing cash flow.

Discover the benefits of Techcombank QR Code payment in the digital era

Outstanding advantages of Techcombank QR Code payment

Pay by Techcombank QR Code brings superior convenience by helping customers save time and minimize data entry operations. Instead of remembering complex account numbers, users just need to scan the QR code for quick payment. This technology also contributes to enhancing security through transaction information encryption.

- Pay anytime, anywhere; no need for cash or physical cards

- Reduce errors due to incorrect account number entry

- Directly integrated in the Techcombank mobile app

- Support diversification of payment methods: shopping, services, money transfer

How to create Techcombank bank account QR Code

For convenience in receiving money or payments, customers can easily create Bank account QR Code according to the following steps:

- Log in to Techcombank Mobile app

- Select QR Payment or Create personal QR code

- Enter account information or requested amount

- Confirm to let the system automatically generate QR code

- Save or share QR code with the payer

Safety checklist when using Techcombank QR Code

| Action | Purpose |

|---|---|

| Update Techcombank app to the latest version | Ensure security features and stability |

| Do not share QR code on unsafe platforms | Reduce risk of scams and fraud |

| Verify recipient and sender before transaction | Avoid money loss due to wrong account |

Real example: A small store in Hanoi said that after applying Techcombank QR code payment, payment time was shortened by up to 40%, while minimizing transfer errors thanks to automation. According to the State Bank of Vietnam report (2023), QR payments have contributed to 25% growth in digital banking services compared to the previous year.

Takeaway: Techcombank QR code payment is not only convenient but also enhances security, helping users optimize financial experience in the digital era.

Simple steps to create Techcombank bank account QR Code quickly and safely

Preparation before creating Techcombank QR Code

Before starting, ensure you have a Techcombank account and have registered for Internet Banking or Mobile Banking services. This helps you fully access QR code creation features for payment. In addition, check stable internet connection to avoid interruptions during operations.

- Log in into F@st mobile app or Techcombank Internet Banking

- Prepare account information and linked phone number

- Check app update to the latest version

Steps to create Techcombank bank account QR Code

Creating Techcombank Account QR Code only involves a few simple steps as follows:

- Log in to the Techcombank app on your phone.

- Select “Payment” or “Create personal QR code”.

- Enter the amount to receive or leave blank if not predetermined.

- Confirm information and select “Create QR code”.

- Save or share the QR code with the person who needs to pay.

Safety checklist when creating and using QR Code

To ensure safe transactions and avoid scam risks, you should note:

| Step | Specific action | Note |

|---|---|---|

| 1 | Only create QR through the official Techcombank app | Avoid using third-party apps of unknown origin |

| 2 | Carefully check the amount and recipient information before sending | Minimize transaction error risks |

| 3 | Do not share QR code on unsafe public platforms | Limit the risk of forgery or information theft |

| 4 | Use two-factor authentication and update software regularly | Enhance account security |

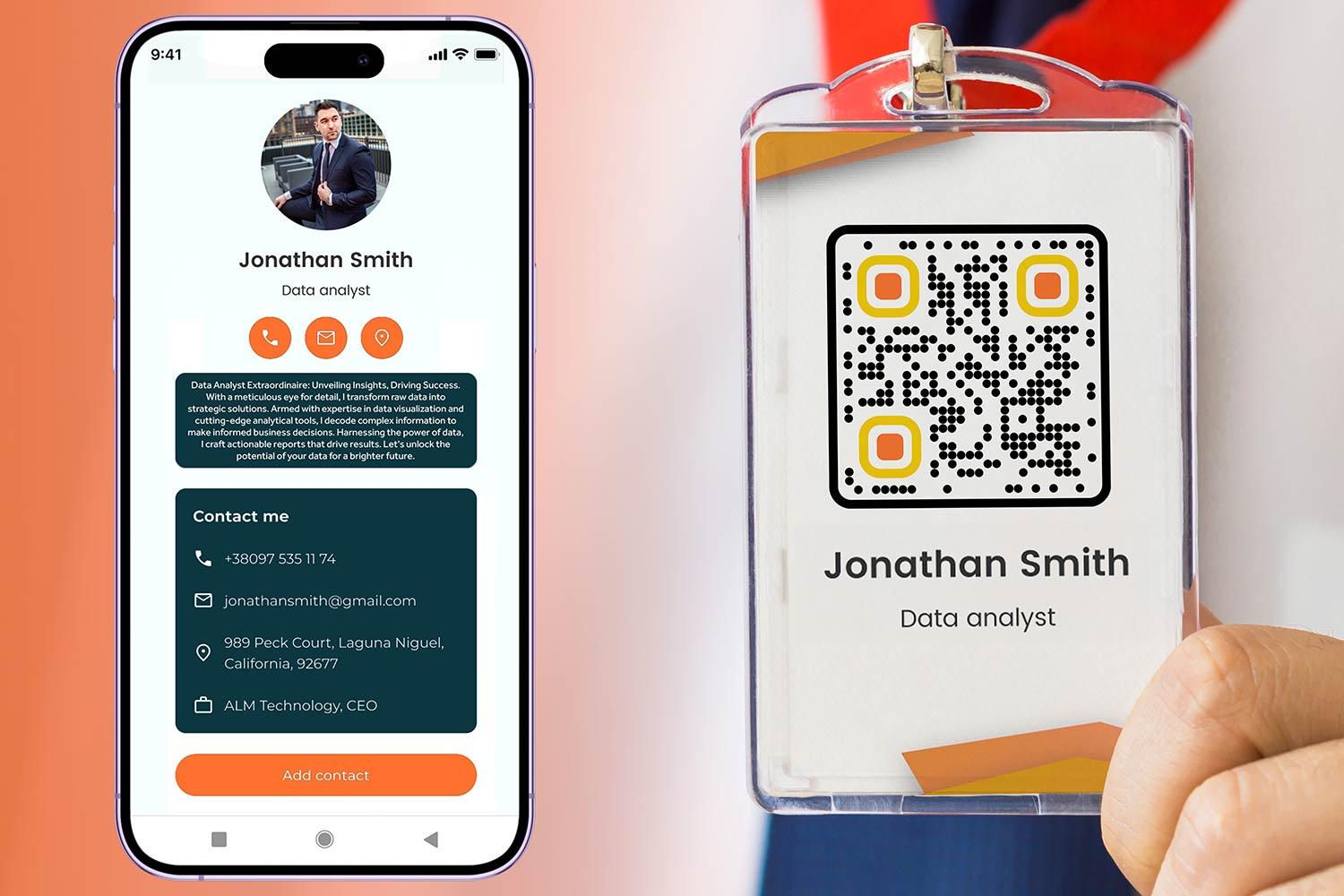

Strategy for using QR Code to enhance customer experience for SMEs businesses

Application of QR Code in improving customer experience

QR Code increasingly popular in SMEs, especially in payments and quick communication with customers. Integrating QR Code at the point of sale helps shorten payment time, while providing additional product information or promotions instantly. An F&B business in Hanoi recorded a 30% increase in service speed after applying QR Code for payments and ordering (Source: Vietnam Consumer Market Report 2023).

Effective QR Code deployment strategy for smes

To maximize QR Code, SMEs should apply the following steps:

- Create QR Code payment convenient, directly linked to Techcombank account or other banks.

- Place QR Code in visible positions at checkout counters, dining tables, or digital communication channels.

- Combine QR Code with customer experience such as product reviews, promotion information registration.

- Train staff to guide customers on using QR Code quickly and safely.

Checklist to check before applying QR Code

| Step | Goal | Note |

|---|---|---|

| 1. Create accurate QR Code | Ensure linkage to Techcombank bank account | Use reputable QR Code creation tools |

| 2. Test payment | Ensure a smooth process for customers | Test payment with multiple devices |

| 3. Place QR Code in an easily noticeable spot | Increase the likelihood of customers scanning the code | Choose a well-lit, convenient location |

| 4. Train staff | Help customers use QR quickly | Create instructional videos or small flyers |

Takeaway: Apply QR Code not only helps SMEs optimize customer experience but also improves operational performance, thereby contributing to sustainable revenue growth.

Security analysis in QR Code payment and how to protect your bank account

Common security risks when making QR Code payments

Payment via QR Code is increasingly popular but also harbors many risks such as fake codes or tampering. Hackers can create fake QR Codes to steal account information or redirect money to scam accounts. According to Kaspersky's 2023 Cybersecurity report, over 251,000 attacks related to fake QR Codes caused significant damage to users. Therefore, understanding security risks is the essential first step when using this method.

How to protect your bank account when using QR Code

You can apply some simple but effective measures to protect your account when paying by QR Code:

- Carefully check the QR Code source: only scan codes from bank apps or reputable partners.

- Use Techcombank's official app: Avoid using third-party apps of unknown origin.

- Enable transaction notifications: Receive immediate alerts for suspicious transactions.

- Regularly update software and operating system: To avoid security vulnerabilities.

- do not widely share personal QR Codes: Especially on social media or unsafe places.

Quick checklist to protect account when creating and sharing QR Code

| Action | Security Meaning |

|---|---|

| Accurately check the account number when creating QR code | Avoid confusion, mistaken transfers, or exploitation |

| Use Techcombank's official QR generator tool | Minimize the risk of QR code tampering |

| Limit QR code sharing in trusted friend groups | Limit QR Code theft or impersonation |

| Enable alerts for transactions from QR Code | Quickly detect abnormal transactions |

Real-life examples of risks and how to avoid them

A case in Ho Chi Minh City in 2023, a Techcombank customer was scammed out of nearly 10 million VND by scanning a fake QR Code on social media. Thanks to quickly activating transaction alerts and contacting the bank, the amount was locked in time. This case shows the importance of protecting and checking QR Codes before payment.

Application of QR Code payment in business operations and tips to optimize effectiveness

Application of QR Code payment in business

The integration of QR Code payment into business operations helps improve customer experience and minimize cash risks. Many stores, coffee shops, and supermarkets today have adopted this method to increase transaction speed and control cash flow more tightly. For example, a chain of stores in Ho Chi Minh City recorded a 25% increase in transaction volume within 3 months thanks to implementing QR Code payment (Source: State Bank, 2023).

Tips to optimize QR Code usage effectiveness

To make the most of this technology, you should pay attention to:

– Place the QR code in a convenient, easily visible position for customers.

– Ensure the QR code is printed clearly, not blurred or damaged.

– Combine QR payment with promotions to stimulate transactions.

– Monitor and analyze transaction data to adjust strategies appropriately.

Optimization checklist when creating bank QR Code

| Category | Requirements |

|---|---|

| Accurate account information | Ensure account number and bank name are correct |

| Standard format | Use standard according to bank guidelines |

| Check code before printing | Test scan to confirm the code works accurately |

| Choose appropriate size | Easy to scan in all lighting conditions |

Takeaway: Application QR code payment helps speed up and secure transactions, but requires regular checking and maintenance for optimal efficiency.

Solution to optimize enterprise cash flow management through Techcombank QR Code

Advantages of using Techcombank QR Code in cash flow management

Applying Techcombank QR Code helps businesses speed up cash collection and minimize transaction confusion risks. Transactions are processed instantly, improving cash flow and optimizing capital flow more effectively. In particular, this also helps reduce operating costs compared to traditional payment methods.

- Fast payment, simple operations just via smartphone.

- Minimize errors thanks to automated transaction recognition.

- Easy integration with modern accounting management software.

How to create Techcombank bank account QR Code for businesses

To create Techcombank Account QR Code, businesses only need to log in to the F@st Mobile app or online banking. After confirming the information, the QR code will be automatically generated, which can be printed or shared via email, social media.

- Log in to the Techcombank app for businesses.

- Select “Create Payment QR Code” and enter account information.

- Download or print the QR code to serve customer payments.

Checklist for controlling and optimizing cash flow via QR Code

- Ensure QR Code setup matches the payment type (advance payment, invoice payment).

- Periodically check actual transactions match report data.

- Standardize reconciliation processes for receipts and payments using support software.

- Continuously update privacy policies to avoid fraud risks.

- Centralize employee permissions, limit unnecessary access.

| Criteria | QR Code Benefits | Implementation Recommendations |

|---|---|---|

| Collection Time | Reduce 50% compared to traditional transfers | Apply to online payments and at point of sale |

| Transaction Accuracy | Reduce data entry errors below 1% | Use integrated accounting software |

| Operating cost | Reduce 20-25% compared to cash payments | Train employees to use QR Code effectively |

Takeaway: Using Techcombank QR Code is an effective solution to help businesses manage cash flow transparently and quickly, but strict controls must be maintained to prevent risks.

Cashless payment trends and the important role of QR Code in enterprise digital transformation

Cashless payment trends in Vietnam

Cashless payments are increasingly popular due to technological advancements and demand for convenient transactions. The *State Bank of Vietnam 2023* report shows that QR Code transactions account for up to 35% of total electronic transactions, with annual growth over 40%. Users prioritize fast, secure, and easy-to-use payment methods instead of carrying cash.

- Convenient: pay anytime, anywhere via smartphone

- Secure: Minimize risks of cash loss or forgery

- Popular: Support diverse service types and brands

Important role of QR Code in enterprise digital transformation strategy

QR Code is an important bridge that helps businesses reach customers quickly and optimize costs. For example, a chain of stores that just implemented Techcombank QR Code payment has recorded a direct revenue increase of 25% after 6 months, while reducing operating costs by up to 15%. QR Code also promotes seamless transaction experiences and enhances customer satisfaction levels.

- Select a reputable and stable QR Code provider

- Ensure multi-platform payment integration (mobile, web)

- Configure payment data security and encryption

- Train staff and communicate the new method to customers

challenges-and-notes-when-deploying-qr-code-payment

Although enabling fast payments, QR Code still poses some risks such as forgery, technical errors, or lack of popularity among older user groups. Businesses need to proactively update software, periodically check systems, and warn customers about common scam methods. Failure to ensure data security also leads to risks of losing reputation and finances.

| Advantages | Challenges |

|---|---|

| Fast, contactless payment | Risk of QR Code forgery |

| Reduce operating and printing costs | Dependence on stable internet infrastructure |

| Easy integration with reputable bank apps | Need to raise awareness and train users |

Preparation for the next journey

Techcombank QR Code payment makes transactions faster, safer, and more convenient than ever. Creating a bank account QR code is very simple, promoting effective cashless payments.

Start creating your Techcombank account QR code today. Experience convenience and promote digital payments in your daily life.

Explore more digital marketing methods to help SME businesses grow. Learn how to apply blockchain technology and e-wallets in business.

DPS.MEDIA always accompanies you in your digital marketing strategy. Don't hesitate to leave comments and share your experiences below the article!