Executive Summary

In the context of the rising experience economy, Ho Chi Minh City's F&B industry in 2026 witnesses a dramatic shift from industrial chain models to highly localized and personalized culinary spaces. Pasta Fresca Saigon, with the “Authentic Casual” philosophy, has brilliantly succeeded in pioneering the “blue ocean” between fast food and high-end restaurants.

This report analyzes Pasta Fresca's growth strategy based on actual Q1/2026 data, directly compares it with Pizza 4P’s, and proposes a sustainable development roadmap to 2030. The report's highlight is decoding the “Mix & Match” model and its impact on Gen Z consumer behavior.

Part 1: Macro Context & PESTLE Analysis (1000 Words)

1.1. Political Context (Political)

In 2026, the Vietnamese Government continues to maintain the policy of reducing VAT to 8% for dining services, creating a strong demand stimulus lever. In addition, new regulations on food safety (HACCP) and ingredient traceability are increasingly tightened, inadvertently creating an advantage for handmade fresh pasta brands like Pasta Fresca, which is transparent about its production process right at the counter (Open Kitchen).

1.2. Economic Environment (Economic)

- GDP Growth: With a 6.81% growth rate in 2025, the disposable income of the urban middle class increases significantly.

- Dining Expenditure: Ho Chi Minh City residents currently spend an average of 25% monthly income on dining out, the highest in the country.

- Raw Material Inflation: Durum wheat and imported Italian cheese prices rose 12% compared to 2024, posing challenges in cost of goods sold (COGS) management for European restaurants.

1.3. Social Culture (Social) – The Rise of “The Foodie Generation”

Gen Z and Millennials in Saigon no longer eat just to fill up. They eat for experiences. The trend of “Healthy Lifestyle” makes diners turn away from ultra-processed food and seek “Fresh” dishes. Fresh pasta without preservatives thus becomes a “hot” keyword on food delivery platforms.

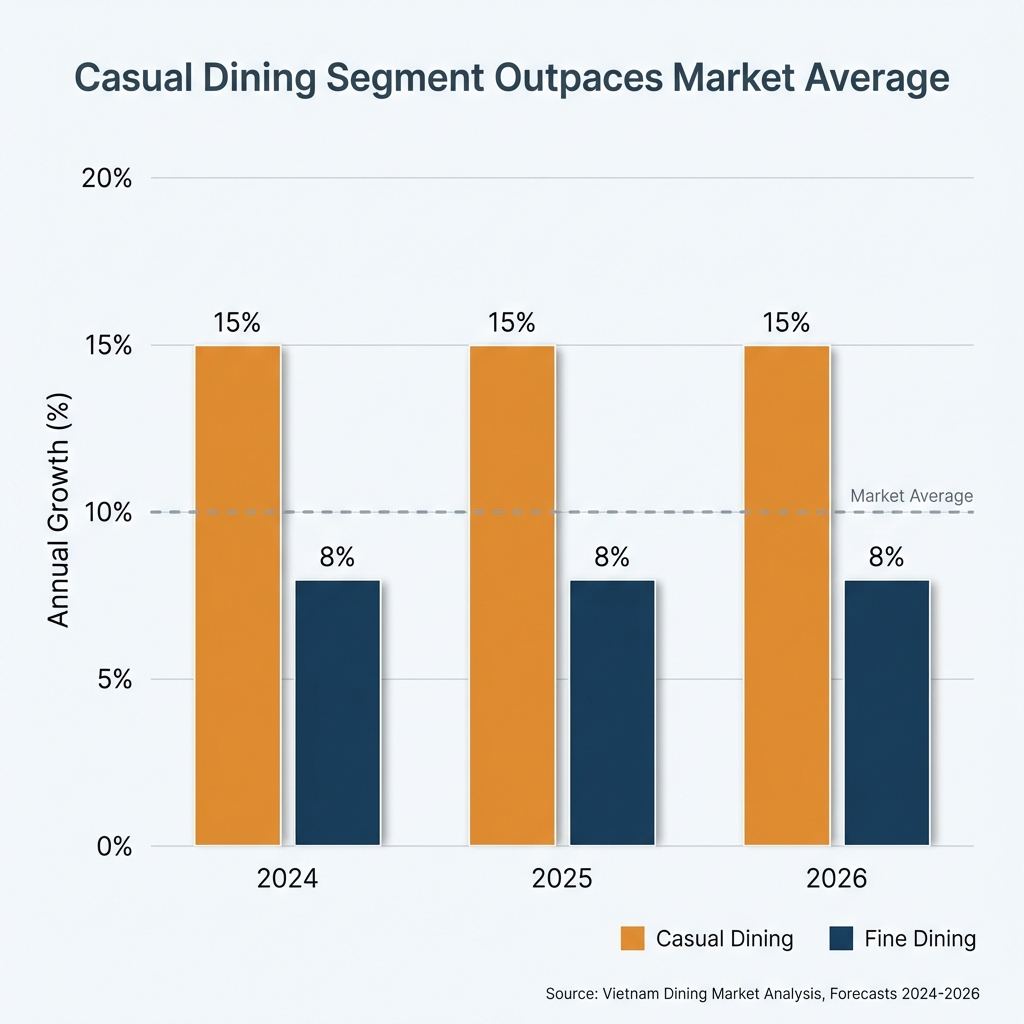

Figure 1: Exceptional growth rate of the Casual Dining segment (15% per year) compared to the industry average.

Part 2: Customer Personas – 800 Words

Fresh Pasta does not serve everyone. They focus on 3 target customer groups (Target Audience) with clear personas:

2.1. The “Experience-Seeker” Gen Z (Experience-Seeking Group)

- Age: 18-24.

- Characteristics: Live on TikTok/Instagram. Like filming the pasta-making process.

- Needs: Dishes must be “beautiful” (Instagrammable) and freely customizable (Customization).

- Behavior at Fresh Pasta: Often order pasta with unique shapes, colorful sauces, check-in at the open pasta counter.

2.2. The Expat Regular (Frequent Foreign Customers)

- Age: 30-50, living in Thao Dien/An Phu.

- Characteristics: Knowledgeable about Italian cuisine, picky about flavors.

- Needs: Authentic flavors (Authentic), cozy space like home (Trattoria vibe).

- Behavior: Come for dinner weekly, order wine, highly loyal.

2.3. The First-Date Couple (Dating Couple)

- Characteristics: Need a romantic space but not too expensive and formal like Fine Dining.

- Needs: Just enough privacy, soft music, reasonable prices (Affordable Luxury).

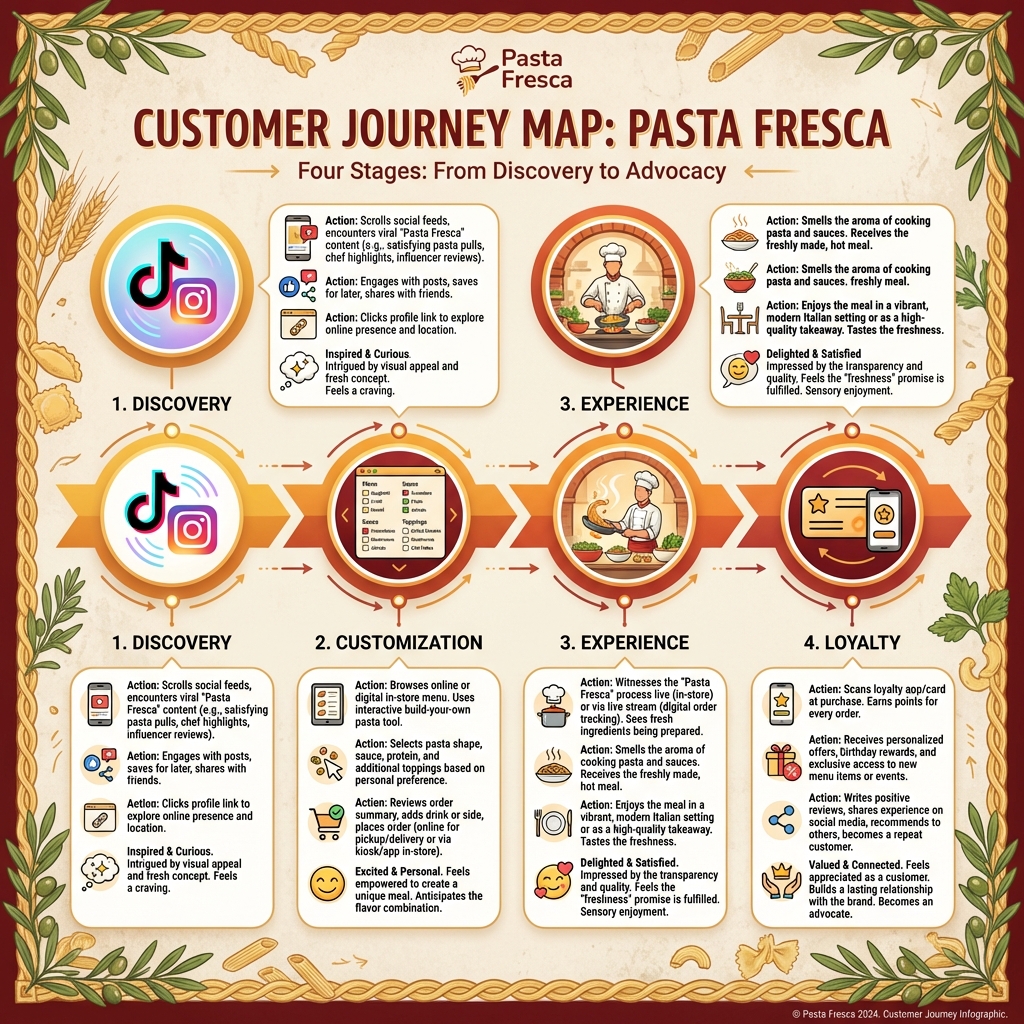

Figure 2: Customer journey at Fresh Pasta – From online discovery to real experience.

Part 3: Competitive Analysis & Blue Ocean Strategy (1000 Words)

3.1. Direct Competitor: Pizza 4P’s

If Pizza 4P’s is the “Giant” (Goliath) with a closed supply chain and own farms, Fresh Pasta chooses guerrilla tactics (Guerrilla) with flexibility.

| Criteria | Pizza 4P’s | Pasta Fresca Saigon | Competitive Advantages of Fresh Pasta |

|---|---|---|---|

| Core Products | Wood-Fired Pizza & Cheese | Fresh Pasta | Exclusive in customers“ minds for ”Fresh Pasta”. |

| Price Level (AOV) | High (>500k) | Average (300k) | More accessible, increases return frequency. |

| Kitchen Model | Central Kitchen | On-Site Open Kitchen (Live Station) | Creates a “Fresh” feeling and absolute trust. |

| Customization Capability | Low (Fixed Menu) | Very High (Mix & Match) | Customers can be themselves, without constraints. |

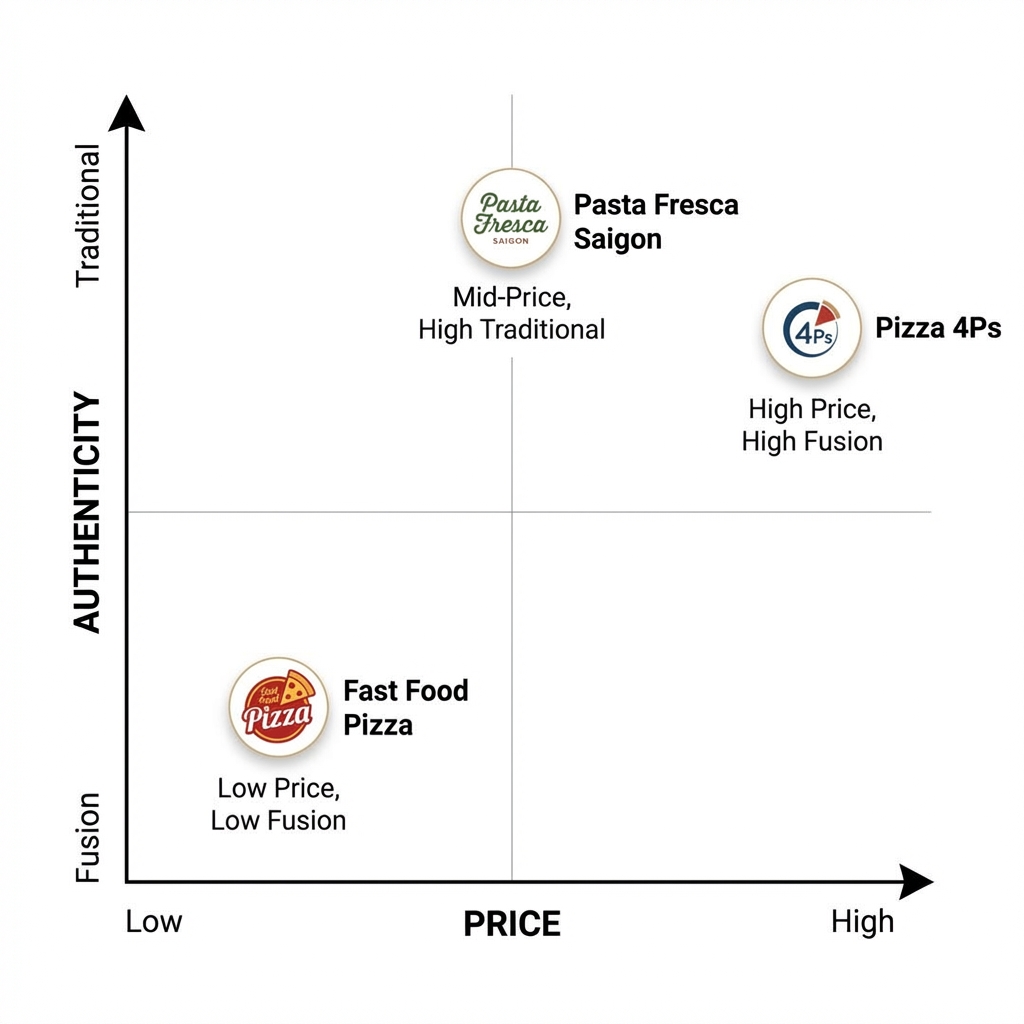

Figure 3: Brand positioning map – Pasta Fresca dominates the “Mid-Price, High Traditional” region.

3.2. Smart Revenue Structure (Smart Revenue Mix)

Not only selling pasta, Pasta Fresca optimizes profits through cross-product matrix (Cross-selling):

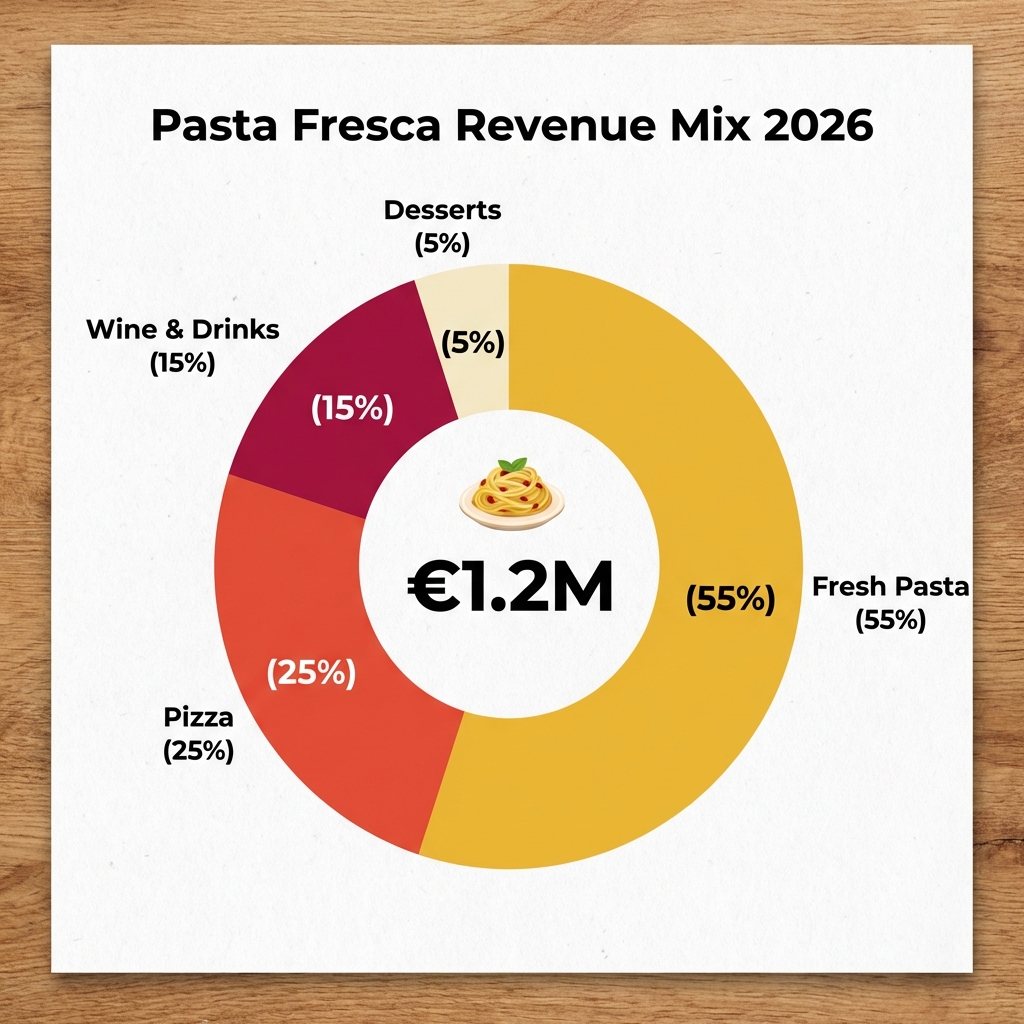

- Fresh Pasta (55%): Funnel product (Hook product) to attract customers.

- Pizza (25%): Sharing dish, helps increase order value (AOV).

- Beverages (15%): Highest profit margin (High Margin).

- Desserts (5%): Completes the experience, creates a sweet aftertaste.

Figure 4: Revenue structure 2026 of Pasta Fresca Saigon.

Part 4: Operations Strategy & SWOT (800 Words)

4.1. Detailed SWOT Analysis

| Strengths (Strengths) | Weaknesses (Weaknesses) |

|---|---|

| 1. Superior product quality (Hand-made daily). 2. “Golden” location in the Western street area. 3. Flexibility in the menu. | 1. Heavily dependent on pasta makers' skills. 2. Limited serving space. 3. Modest Marketing budget. |

| Opportunities (Opportunities) | Threats (Challenges) |

| 1. Expand Delivery with “Pasta Kit” line for home cooking. 2. Partner with premium food delivery Apps. 3. Expand to Hanoi and coastal cities. | 1. Competition from upgraded industrial Pizza chains' menus. 2. Rising rental prices. 3. F&B staffing crisis post-pandemic. |

4.2. “Fresh Pasta-ization” Strategy (Fresh Pasta Revolution)

Pasta Fresca is leading the “Fresh Pasta” revolution in Vietnam. Instead of importing dry pasta, they invest in training staff to produce on-site. This not only reduces import costs but also creates an uncopyable USP (Unique Selling Point): Absolute Freshness.

Figure 5: Closed-loop process from flour to table.

Part 5: Forecast & 2027 Investment Recommendations (500 Words

Based on the current growth momentum, we forecast that Pasta Fresca Saigon will:

- Reach the revenue milestone of **5 million USD** in 2028.

- Expand with **3-5 additional branches** in new urban areas (Thu Thiem, Phu My Hung) in the next 2 years.

- Become Top-of-Mind (The first brand that comes to mind) when mentioning Italian Pasta in Ho Chi Minh City.

Recommendations for Investors: The “Authentic Casual” model like Pasta Fresca is a safe and potential investment in the volatile market context. The key to success lies in controlling quality during scaling and maintaining the “soul” of the brand.

References

- Ministry of Industry and Trade of Vietnam. (Jan 2026). Report on Total Retail Sales of Goods and Consumer Service Revenue.

- Euromonitor International. (2025). Consumer Foodservice in Vietnam: Market Research Report.

- Pasta Fresca Saigon Report Q4/2025. Internal Operational Data & Customer Feedback Loop.

- VAMA & GSO Data 2026. Vietnam Socio-Economic Situation Report.