Executive Summary

In 2026, Vietnam's fashion industry witnesses a spectacular “regime change”. For the first time in history, local brands (Local Brands) dominate 45% market share, surpassing international Fast Fashion giants like Zara, H&M, Uniqlo. The driving force behind this change comes not only from national pride but also from a deep understanding of the “Social Commerce” behavior of Generation Z – those who see TikTok Shop as a “runway” and the shopping cart as a “personal style statement”.

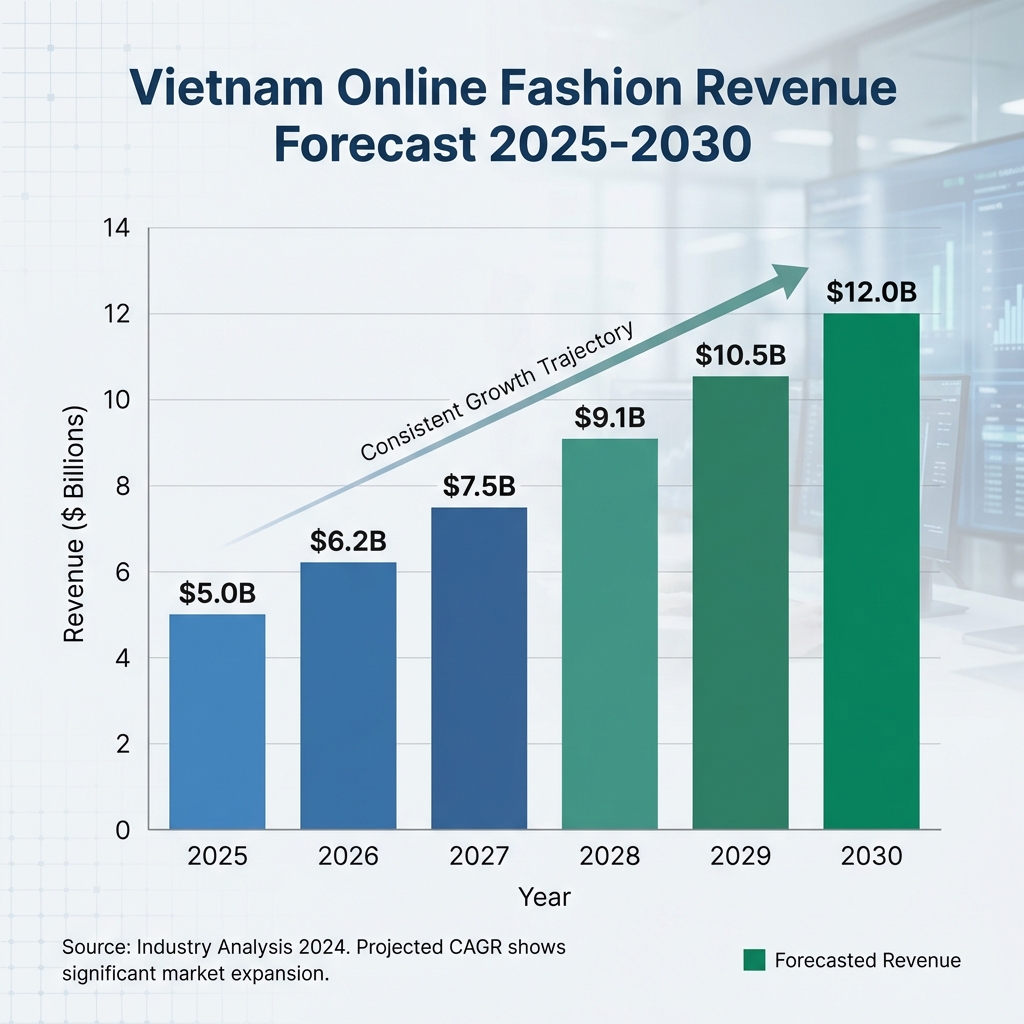

The “Vietnam Fashion Market 2026” report by DPS Media will provide a comprehensive overview of the projected market size reaching 10 billion USD, in-depth analysis of “Shopertainment” strategies (Entertainment Shopping) and a digital transformation roadmap for fashion retail businesses in the next 5 years.

Part 1: Market Context & PESTLE Analysis

1.1. Politics & Law

New regulations on “Cross-Border E-Commerce Tax” effective from January 2026 have created a fairer “technical barrier” for domestic businesses. Cross-border platforms (like Shein, Taobao) now face import duties and VAT totaling up to 15%, reducing the price competitiveness of cheap Chinese goods. This is a “golden opportunity” for Local Brands to reclaim their home turf.

1.2. Economy

Despite global economic fluctuations, Vietnam's middle class continues to spend generously on appearance. Data from Vietnam Household Living Standards Survey 2026 shows: Spending on clothing and footwear accounts for 6.5% total household income, up 1.21% from 2024. The “Affordable Luxury” trend (affordable branded goods) is invading the wardrobes of young Vietnamese.

1.3. Society – The Era of “Hyper-Personalization”

Customers in 2026 don't buy “Trends”, they buy their own “Style”. The rise of Micro-community communities (small groups with shared interests) like Y2K, Dark Academia, or Coquette has fragmented the mass market into thousands of lucrative “niches”.

| Factors | 2024 | 2026 | Changes |

|---|---|---|---|

| Channel Dominance | Facebook & Shopee | TikTok Shop & Brand Website | Shift to Video-First Marketing. |

| Key Influencer | Celeb (Celebrity) | KOC (Key Opinion Consumer) | Trust placed in “Authentic Reviewer”. |

| Purchase Decision | Price & Promotions | Emotions & Brand Stories | Buy for the “Vibe”, not just because it's cheap. |

Part 2: Market Share Battle: Local Brands vs. Global Giants

2.1. The Rise of the “Local Brand Empire”

Vietnamese brands like DirtyCoins, Levents, LSeoul are no longer just “t-shirt printing shops”. They have transformed into professional “Fashion Houses” with systematic R&D processes. Their biggest advantage is Speed (Speed-to-Market): Only 14 days to turn a Pinterest idea into a shelf product, twice as fast as the 30-45 day process of international Fast Fashion in Vietnam.

2.2. International Fast Fashion: Slowing Down for Greater Sustainability

Uniqlo and Zara are adjusting strategies. Instead of chasing quantity, they focus on basic product lines (Basics) and sustainable fabric technologies (AIRism, Heattech) to retain office workers who love minimalism and stable quality.

Figure 1: Fashion industry market share structure 2026 – Dominance of Local Brands (45%).

Part 3: The Era of Ubiquitous Social Commerce

3.1. Shopertainment: Shopping is Entertainment

Customers no longer enter the App to shop for a shirt. They enter to watch entertaining livestreams and “accidentally” place orders. TikTok Shop and Shopee Live have turned shopping into a real-time interactive experience. Live sessions lasting 12-24 hours with million-dollar revenue have become the “new normal”.

3.2. The Customer Journey “TikTok-First”

Purchase process (Customer Journey) is no longer linear. It is an endless loop of Discovery and Sharing:

- Discovery: Seeing a beautiful dress in a 15s dance video.

- Validation: Watch Livestream to see the real fit on models (Try-on).

- Action: Hunt Flash Sale in 30s for fear of missing out (FOMO).

- Advocacy: Record “Unboxing” video to show off to the community.

Figure 2: 5 Steps in fashion shopping journey on short video platforms.

Part 4: Sustainable Development & “Slow Fashion”

4.1. From “Fast” to “Green”

The paradox of 2026 is: Customers buy fast (Fast Purchase) but demand green products (Green Product). Keywords like “Recycled Polyester”, “Organic Cotton”, “Second-hand” (2hand) have seen search volumes surge 300%.

4.2. Solutions for Businesses

- Supply Chain Transparency.

- Implement “Trade-in” program for old items to extend product lifecycle.

- Use biodegradable packaging instead of plastic bags.

Part 5: 2030 Market Forecast

5.1. Comprehensive O2O (Online-to-Offline) Model

Physical stores won't disappear, but their role will change. They will become “Experience Hubs” – where customers try on clothes, scan 3D body, receive style advice, then have items shipped home.

5.2. The Explosion of AI Fashion Design

Artificial Intelligence (AI) will participate in design. Brands can launch 100 virtual designs daily to test the market, only producing high pre-order ones, reducing inventory to zero.

Figure 3: Vietnam's online fashion revenue expected to hit 12 billion USD by 2030.

Conclusion

Vietnam's fashion industry in 2026 is a playground for the “Fast” and “Deep”. Fast in capturing Social trends, and Deep in building sustainable brand value. DPS Media believes that Local Brands, if maintaining current momentum, can fully go global, bringing Vietnamese identity to the world.

(Exclusive report by DPS Media Research Team – Jan 2026)

References

- Vietnam Ministry of Industry and Trade (MoIT). (Jan 2026). Vietnam E-commerce Report 2025.

- Metric.vn & Reputa. (2026). Social Commerce Market Share Q4/2025.

- McKinsey & Company. (2025). State of Fashion 2026: Asia-Pacific Edition.

- Statista. (2026). Revenue of the Fashion Market in Vietnam 2024-2030.

- ByteDance Internal Data. (Jan 2026). TikTok Shop Fashion Category Insights.