Executive Summary

Never before have Vietnamese consumers been so “knowledgeable” (educated) about cosmetics as in 2026. The term “Skintellectual” (Skin-savvy consumer) has become the new standard. They no longer believe in “instant skin whitening” ads. They scrutinize the ingredients list, seek Vegan/Cruelty-free certifications, and place absolute trust in knowledgeable KOCs (Key Opinion Consumers).

This report analyzes the scale of the Vietnamese cosmetics market valued at 3.5 billion USD, where the Skincare product line is leading with 60% market share, pushing Makeup to a secondary position. Notably, the rise of local brands like Cocoon, Lemonade is rewriting the rules of the game at home.

Part 1: Market Context & PESTLE Analysis

1.1. Politics & Law

In 2026, the Vietnam Ministry of Health applies the amended ASEAN Cosmetic Directive (ACD), tightening regulations on concentrations of active ingredients like Retinol and BHA in over-the-counter cosmetics. This has eliminated numerous “mixed creams”, cosmetics of unknown origin from the market, paving the way for transparent Cosmeceuticals brands to rise.

1.2. Economy

Rising per capita income means “Beauty Spending” becomes an essential expense, not a luxury. Vietnamese women on average spend 500,000 – 1,000,000 VND/month on 5-7 step skincare routines.

1.3. Society – “Clean Beauty” Wave”

“Beautiful but Safe”. The Clean Beauty trend (Clean cosmetics) is no longer a fleeting fad but a lifestyle. Users prioritize natural (vegan) ingredients, recyclable packaging, and brands with social responsibility (CSR).

| 2024 Trends | 2026 Trends | Change Drivers |

|---|---|---|

| Whitening (Whitening) | Healthy Glow (Healthy Radiant Skin) | Shifting beauty standards to natural. |

| Influencer Marketing | KOC & Dermatologist (Dermatologist) | Demand for scientific validation. |

| Offline Shopping | Omnichannel (TikTok Shop + Guardian) | Convenience and seamless experience. |

Part 2: Market Segments: Skincare Is King

2.1. Skincare Dominance

Polluted climate and high-intensity UV rays in Vietnam make the demand for skin protection and restoration urgent. Treatment products (specialized treatments) containing Niacinamide, Vitamin C, Retinol are the most searched keywords. In contrast, the Makeup market grows slower, focusing on the “Clean Girl” makeup style (makeup that looks like no makeup).

Figure 1: Skincare dominates 60% market share with superior compound annual growth rate (CAGR) compared to Makeup.

2.2. Men – The New “Gold Mine”

The men's cosmetics market (Men’s Grooming) reaches 500 million USD. Vietnamese men in 2026 are not shy about using facial cleanser, sunscreen, and even concealer. This is a niche but highly potential segment for new brands.

Part 3: “The Trust Economy” – Trust Economy

3.1. The Death of Traditional Advertising

Generation Z and Alpha users do not trust TVC ads. They trust real experiences. The purchasing journey now is a complex “Trust Funnel”:

- Social Discovery: Seeing products on TikTok via hashtag #SkinTok.

- Authenticity Check: Watching reviews from “god-level KOCs” (picky reviewers who praise and criticize clearly).

- Expert Validation: Checking if dermatologists recommend it.

- Micro-Trial: Buying mini trial size.

- Loyalty: Buying full size and recommending it.

Figure 2: “The Trust Funnel” model – The key to conquering cosmetics customers in 2026.

Part 4: The Rise of Local Brands

4.1. “Vietnamese Use Vietnamese Goods” Version 2.0

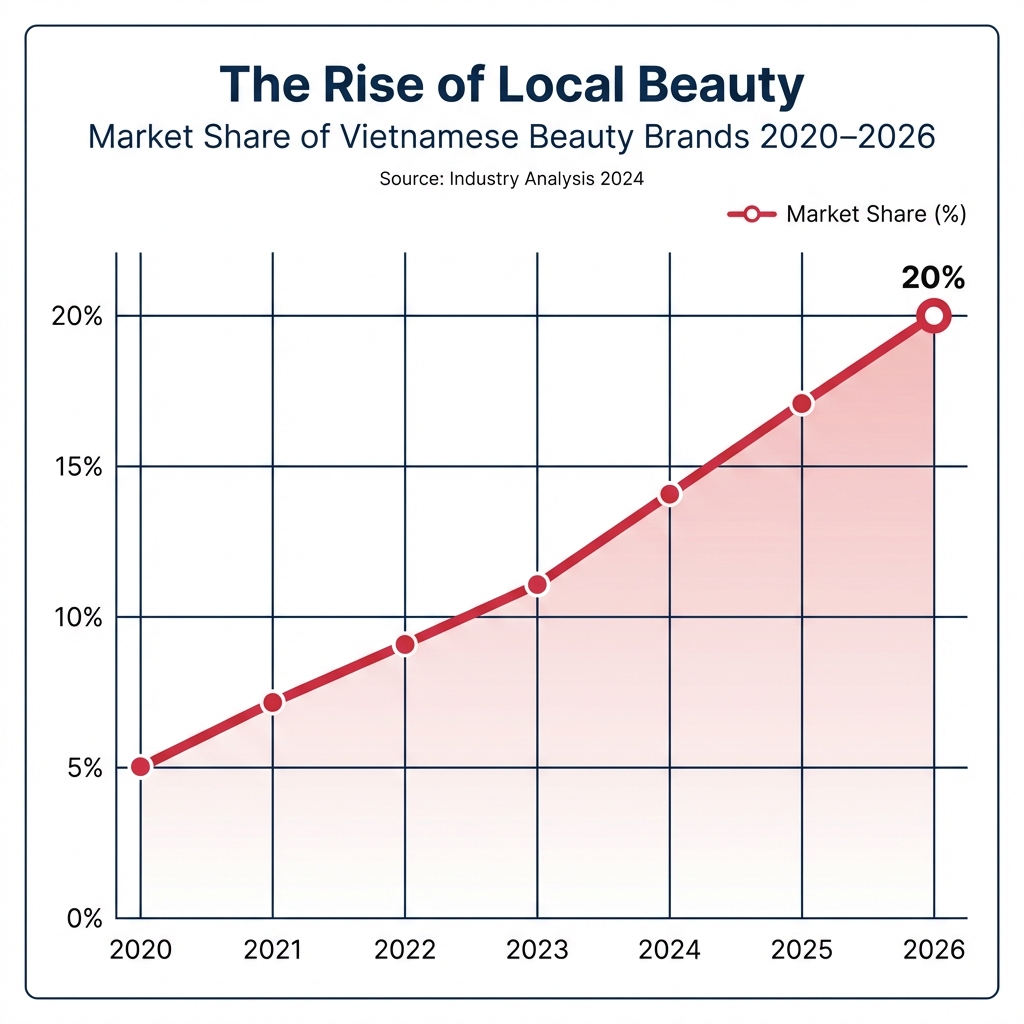

No longer labeled as “cheap”, Vietnamese cosmetics in 2026 confidently compete head-to-head with Korea and Japan in quality and packaging. Brands like Cocoon (Vegan cosmetics from Vietnamese agricultural products), Lemonade (Makeup for Vietnamese women), Thorakao (The return of the legend) have captured 20% market share.

4.2. Competitive Advantage

- Understanding tropical skin: Lightweight products, non-sticky.

- Ingredient story: Using Hưng Yên turmeric, Đắk Lắk coffee, Bến Tre coconut… to create pride.

- Reasonable pricing: Directly competing with hand-carried imports.

Figure 3: Explosive growth of domestic cosmetics brands in the 2020-2026 period.

Part 5: Strategy & 2030 Forecast

5.1. Extreme Personalization (Hyper-Personalization)

The future is the era of “Biotech Cosmetics”. Customers will send gene samples or scan skin via App, brands will concoct a unique serum bottle (Custom-made) tailored to their skin structure. AI will act as a “virtual dermatologist” consulting 24/7.

5.2. Advice for Marketers

- Be Honest. One lie about ingredients can kill a brand overnight (Cancel Culture).

- Build Community, not just build fanpage.

- Invest in long-term KOCs instead of short-term KOL bookings.

Conclusion

The Vietnamese cosmetics market in 2026 is an ocean that is “both blue and red”. Opportunities are wide open for those who do real work, do quality, and know how to tell a kind story. DPS Media affirms: Trust is the most expensive “cosmetic” that brands need to apply.

(Market Research and Consumer Trends – DPS Media Jan 2026)

References

- Euromonitor International. (2026). Beauty and Personal Care in Vietnam.

- Q&Me Market Research. (Jan 2026). Vietnam Cosmetics Market Trends & Consumer Behaviors.

- Kantar Worldpanel. (2025). Beauty Shopper Insights Vietnam.

- Vietnam Ministry of Health. (2026). Cosmetic Management Regulation Updates.

- TikTok For Business. (2026). Beauty Category Insights Report.