Executive Summary

The convenience store (Convenience Store – CVS) market in Vietnam is entering its second explosive growth phase, shaped by profound changes in Gen Z consumer behavior and aggressive rural expansion strategies by major retailers. No longer just places to sell “cigarettes and soft drinks”, CVS Vietnam in 2025 has transformed into “life service stations” (Life Service Stations) integrating multiple conveniences.

Research data shows the market scale is expected to reach the milestone of 12,160 billion VND (equivalent to 486 million USD) in 2025, with an impressive compound annual growth rate (CAGR) above 13%. Alongside WinMart+'s dominance in quantity, the race for service quality and customer experience (CX) among Circle K, GS25, and FamilyMart is creating a new face for modern retail.

Part 1: Overall Market Picture 2024-2025

1.1. Scale & Impressive Growth

In the context of a volatile global economy, Vietnam's retail sector remains a bright spot with total retail sales of goods and consumer service revenue in 2024 estimated to reach record highs. In the CVS segment alone, tourism recovery and fast-moving consumer goods (FMCG) demand have driven strong revenue growth.

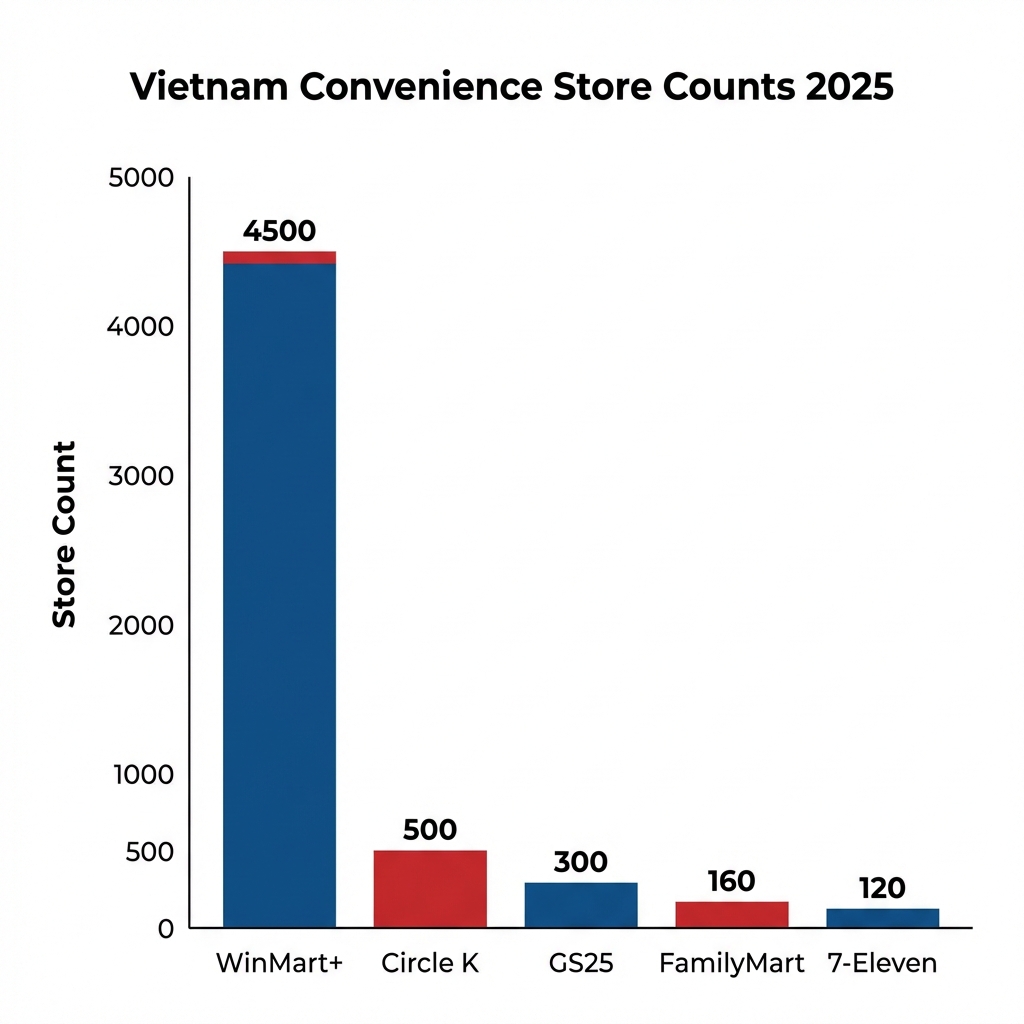

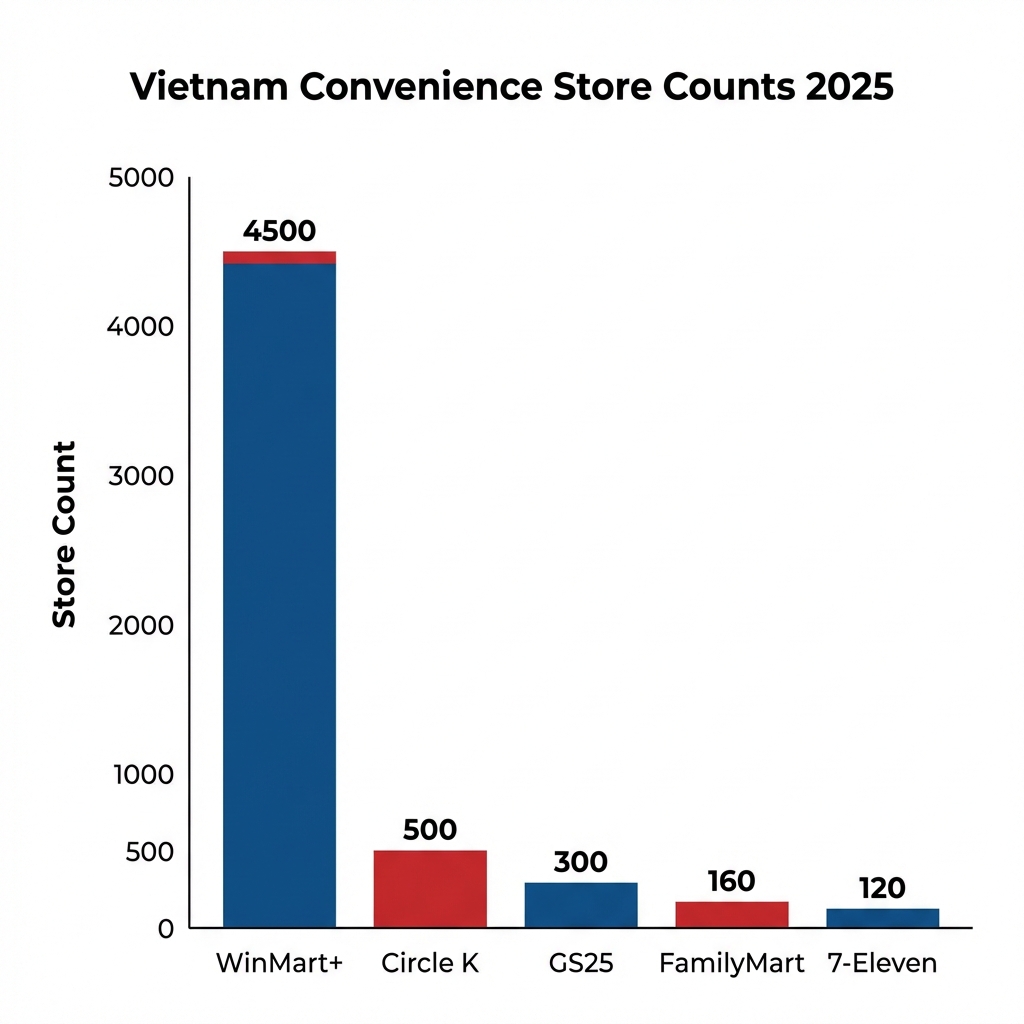

The chart below illustrates the dominance in store count of major chains, showing deep market penetration:

1.2. Store Count Growth Data

Below is a summary table of estimated store counts for leading brands as of early 2025:

| Brand | Store Count (Est. 2025) | Business Model | Core Strategy |

|---|---|---|---|

| WinMart+ | ~4,500+ | Owned Chain & Franchise | Nationwide coverage, strong rural attack (Rural Penetration > 42%) |

| Circle K | ~500 | Franchise (Master License) | Youth focus, F&B (Hot prepared food), 24/7 operations |

| GS25 | ~300 – 500 | Franchise | “Lifestyle Platform”, rapid expansion through low-cost franchising |

| FamilyMart | ~160 | Ownership & Franchise | Japanese standard service quality, ready-to-eat food (Oden, Bento) |

| 7-Eleven | ~120 | Franchise | Exclusive menu, expansion to Hanoi, digital technology application |

Part 2: Competitive Analysis & Franchise Model (Competitive Landscape)

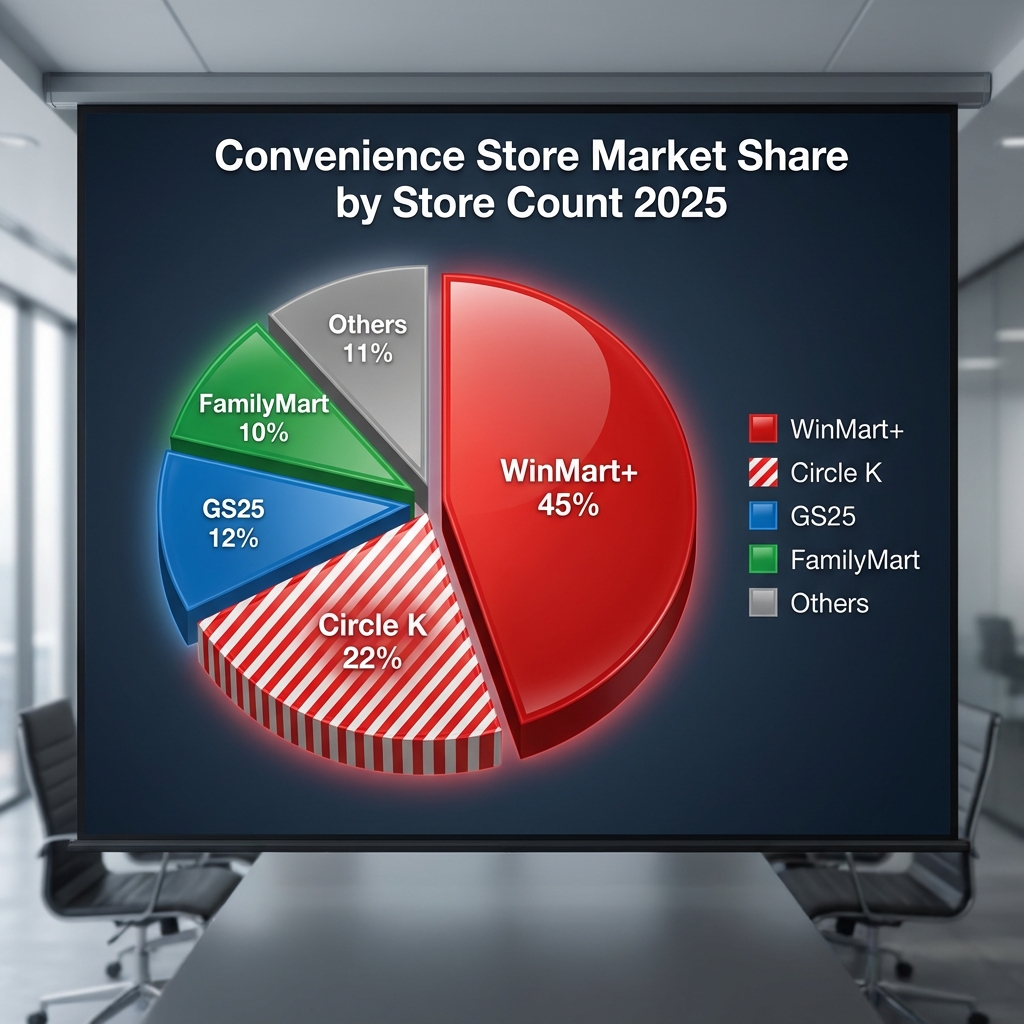

2.1. “Market Share Battle” (The Battle for Market Share)

The CVS market share in Vietnam is clearly differentiating. In terms of coverage (number of stores), WinMart+ holds an absolute “dominant” position thanks to the Masan ecosystem. However, in terms of revenue per store (Revenue per Store) and brand love (Brand Love) among young people, Circle K and GS25 are formidable competitors.

The market share structure by number of stores is visualized in the following chart:

2.2. Franchise Cost Comparison (Franchise Cost Analysis)

The franchise model is the main growth driver for GS25 and expected for 7-Eleven. Below is a comparison table of estimated investment costs:

| Criteria | GS25 | 7-Eleven | Circle K |

|---|---|---|---|

| Initial Franchise Fee | Flexible (packages ~2 billion VND) | High (~37k – 1.6M USD) | Master License model (renowned) |

| Location Requirements | Minimum area 60-100m2 | Prime location, office areas | Street corners, densely populated residential areas |

| Operational Support | Training, supply chain, Marketing | Standard US/Japan management system | Professional 24/7 operating processes |

| Payback Time (Est.) | 3 – 5 years | 5 – 7 years | N/A |

Part 3: Gen Z – The Market-Shaping Generation (The Gen Z Factor)

3.1. “Residents” of Convenience Stores

For Gen Z (born 1997-2012), CVS is not just a shopping place but a “Third Place” (third space) besides home and school/workplace. Statistics show that Gen Z accounts for up to 60% regular customers of CVS chains.

- Food-to-go: Hot prepared dishes (mixed noodles, cup hotpot, steamed buns) are customer magnets. GS25 succeeds greatly with “Korean Noodles Corner”, while Circle K is famous for desserts and trendy drinks.

- Blind Box & Trend Hunting: Gen Z loves surprises. Campaigns selling “Blind Boxes” or TikTok trend products (like grilled sausage on hot stones, hand-pounded iced lemon tea) always sell out at CVS.

3.2. Spending Behavior

Although their income is not as high as previous generations, Gen Z is willing to spend generously on convenient dining experiences. They care less about the price of individual items (lower price sensitivity for small-ticket items) but demand high speed, free WiFi, and air-conditioned spaces to “chill”.

Part 4: Rural Expansion Strategy (Rural Expansion)

As the Hanoi and Ho Chi Minh City markets become saturated in density, the “blue ocean” lies in rural areas and tier 2, 3 urban areas. WinCommerce is the pioneer with the “Point of Life” strategy, integrating multi-utility WinMart+ (including pharmacies, financial services, telecommunications) deep into rural residential areas.

- First-mover advantage: Low rental costs, low competition, increasing demand for standard daily goods.

- Challenge: Complex logistics, strong habits of shopping at traditional markets and grocery stores.

Part 5: 2026 Outlook – The “Phygital” Era”

The future of CVS in Vietnam lies in the intersection of Physical and Digital – or Phygital.

- Super Apps: Ordering via app, multi-purpose loyalty points, contactless payments (QR Code, FaceID) will become the standard.

- Hybrid Model: Combining CVS and Café, CVS and Pharmacy, CVS and Laundry to optimize revenue per square meter.

- Green Logistics: Using electric delivery vehicles and minimizing plastic waste to attract environmentally conscious customers.

The infographic below summarizes the 3 main development pillars of the market until 2026:

Conclusion

The Vietnam convenience store market is in a “pivotal” stage. Competition is no longer about who opens more stores, but who understands customers better and serves them more “conveniently” in the literal sense – from offline to online. Businesses need to focus on digitizing operations, optimizing F&B product categories, and being flexible in franchise models to win this long race.

Data sources: Euromonitor, GSO, CafeF, Internal reports of enterprises, Compiled & Analyzed January 2026.