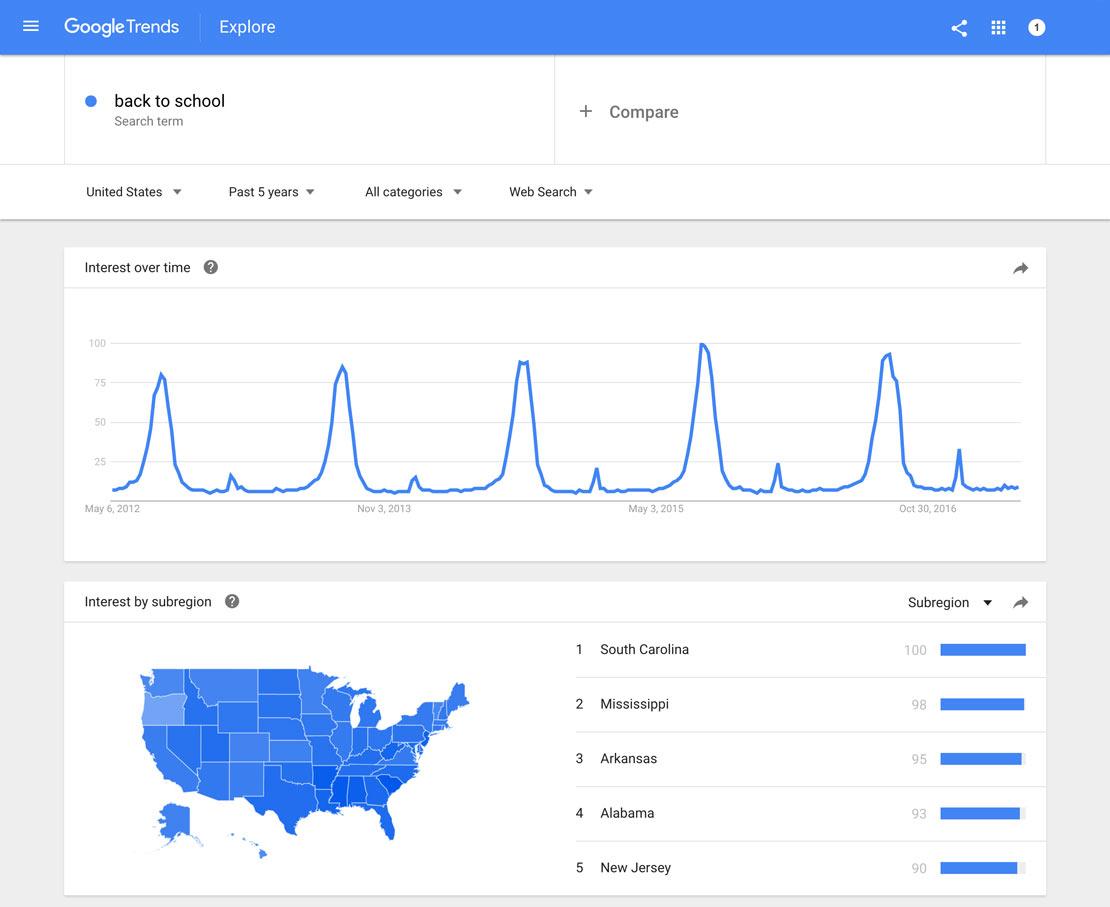

Cốc Cốc Insights shows that search trends are key keywords helping businesses increase conversion rates.

Cốc Cốc 2024 data records a 32% increase in shopping-related queries in Vietnam, according to DPS.MEDIA.

View from DPS.MEDIA: Outstanding search trends on Cốc Cốc and their significance for SMEs

Macro trends on Cốc Cốc

Cốc Cốc reports show that search habits in Vietnam strongly shift towards queries related to local shopping, on-site experience, and content that supports quick decision-making. Mobile device interaction continues to dominate, with over 70% smartphone searches according to platform data. These changes reflect consumers' immediate habits and fast information needs. Capturing the search journey is a priority for SMEs aiming to maintain the ability to reach new customers.

Specific impact on SMEs

Key figures: e-commerce search grows about 35% YoY, tourism and experiential services increase 20%, while online work/study networks record a leap of ~42% (Source: Cốc Cốc Insights 2024). These indicators highlight opportunities to expand scope through local content, optimize mobile SEO, and fully utilize location-based targeting. SMEs need to adjust marketing budgets to focus on conversion keywords and channels with real traffic.

Practical actions for small businesses

Short-term priorities include optimizing mobile-dedicated pages, updating local schema, and creating quick-answer content for user questions (FAQ, price comparison, purchase guides). Medium-term, businesses should experiment with geo-targeted ad campaigns and track conversion rates from specific product searches. Continuous measurement and testing will help optimize CAC and improve marketing investment efficiency.

- Optimize mobile-first: reduce loading time, display phone numbers clearly.

- Focus on local content: titles, meta, and landing pages by district/county.

- Prioritize short content addressing intent (how-to, comparison, price).

- Test ads by position/promotion during peak hours to catch trends.

| Search groups | YoY growth |

|---|---|

| Shopping / E-commerce | +35% |

| Tourism / Experience | +20% |

| Working / Online learning | +42% |

| Callout: SMEs should prioritize local search optimization and mobile-first strategies to catch the wave of growing search queries. | |

| Source: Cốc Cốc Insights 2024 - aggregated data by internal search volume. | |

Takeaway: Focusing on mobile and local content is a practical, fast, and measurable step to help SMEs leverage current search trends to increase revenue growth.

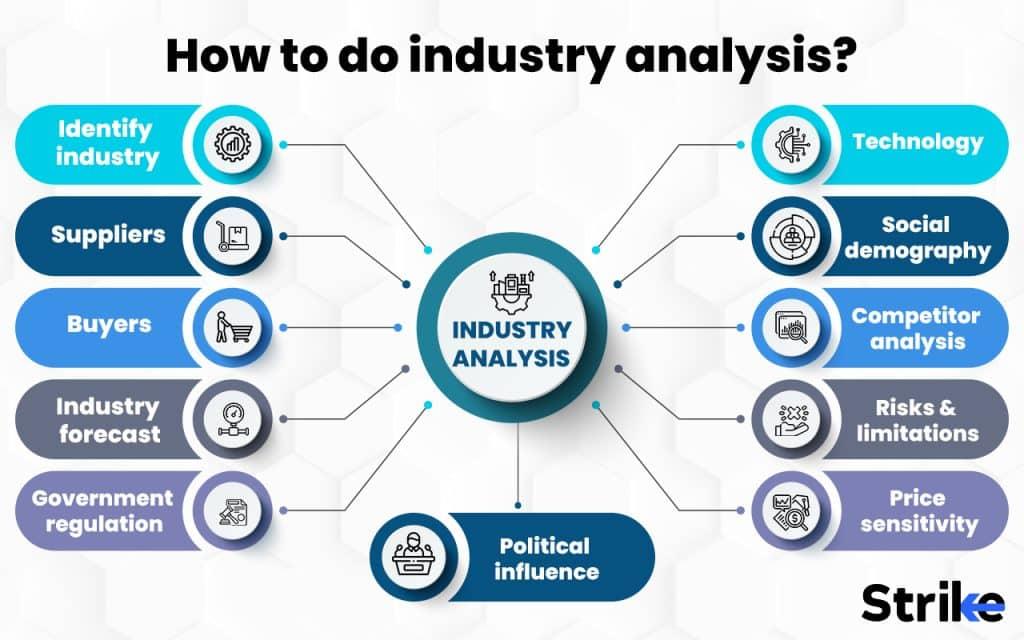

Industry analysis: Growth opportunities and strategic keywords for each customer segment

Retail & e-commerce industry

Cốc Cốc reports show that the retail and e-commerce sector accounts for a large proportion of search volume, with the query “online shopping” increasing by ~34% in 2024 (source: Cốc Cốc). Users prioritize price comparison and look for instructional content, opening opportunities for long-tail keywords. Brands should optimize product pages by intent and improve mobile experience to increase conversion rates.

Local tourism, services, and service industries

The local tourism and service sector is recovering clearly, with search volume for “domestic travel” increasing by 27% in Q1 (source: Cốc Cốc). Users search by season, destination, and experience, so content needs to emphasize itinerary, price, and real reviews. Since mobile queries have a high ratio, optimizing local SEO and review schema will improve visibility and attract local customers.

| Industry | Growth Opportunities | Strategic Keywords (example) | First |

|---|---|---|---|

| Retail / E-commerce | ~34% | online shopping, price comparison, product reviews | High |

| Tourism & Services | ~27% | domestic travel, cheap tours, popular destinations | High |

| Finance & Fintech | ~15% | consumer loans, credit card promotions, interest rates | Average |

| Education & Training | ~22% | online courses, exam preparation, tutoring | Average |

| FMCG / Fast Moving Consumer Goods | ~12% | cheap products, brand comparison, nearby shopping | average |

| Quick Suggestions |

|---|

| Prioritize implementing long-tail keywords and local SEO; optimize mobile experience; measure by conversion to allocate budget effectively. |

- Survey top industry queries on Cốc Cốc to identify main intent.

- Prioritize optimizing product pages, service pages, and local pages (Google My Business / equivalents).

- Create instructional, comparison, and FAQ content to capture long-tail queries.

- Set up conversion tracking and A/B test landing pages for priority keywords.

- Allocate budget by actual ROAS; test search ads combined with content marketing.

Takeaway

Focusing on long-tail keywords, local SEO, and instructional content is the shortest path to leverage industry growth waves. Cốc Cốc data provides specific guidance on strong query growth; brands should measure effectiveness by conversion rather than just visits. For specialized implementation, agencies with data capabilities can support strategy and budget optimization.

User search behavior and intent: Content optimization suggestions, SEO, and creative advertising

Overview of search behavior

Search habits in Vietnam show users have clear intent: shopping and comparison queries dominate, while informational queries still account for a significant portion. According to Cốc Cốc Insights (2024), about 42-45TP3T of queries are transaction-oriented, ~33TP3T informational, and 22-25TP3T navigational; over 85TP3T of searches come from mobile devices. This data reminds us to prioritize mobile experience, loading speed, and content structure suitable for each search intent (Source: Cốc Cốc Insights 2024; Cốc Cốc Ads 2023).

Content & SEO optimization suggestions

Effective SEO strategy starts by classifying keywords by intent: transactional keywords need product pages, informational keywords need in-depth and specific instructional articles. Apply schema, clear titles, and optimized meta descriptions to increase natural CTR; prioritize long-tail keywords for informational queries. A/B test titles and snippets while monitoring CTR, bounce rate, and time on page to timely adjust content.

- Group keywords by intent (transactional / informational / navigational) within 1 week.

- Optimize title/meta for each group, including product schema and FAQ.

- Create pillar + cluster content for important informational topics.

- Prioritize optimizing page speed and mobile display (< 3s load).

- Measure CTR, Dwell Time, conversion rate by keyword group.

Creative advertising by intent

When building ads, clearly map user intent with message and format: transactional intent needs strong CTA and promotions, informational intent needs educational content and lead magnets. Based on Cốc Cốc Ads reports and real experiments with media partners, intent-based campaigns usually improve CTR and reduce CPA compared to general campaigns. Continuous A/B testing combined with remarketing for searchers increases conversions.

| Intent | Core Content | Ad Format | KPIs (reference) |

|---|---|---|---|

| Transaction | Reviews, price comparison, product evaluation | Search Ads, Product Ads, Dynamic Remarketing | CTR 3-7%, CPA decreased 15-30% (Source: Cốc Cốc Ads 2023) |

| Information | Guidance, explanations, checklist | Content Ads, short videos, native | CTR 1-3%, increase in effective visits and viewing time |

| Orientation | Brand, support for store/app positioning | Local Ads, search Brand | CTR 2-5%, increase direct access rate |

| Callout: Start by analyzing real search data to select 20-50 long-tail keywords with sufficient volume and clear intent. Prioritize mobile-first and measure by intent clusters before scaling. |

| Takeaway: Optimize by user intent - keyword classification, adjust content/advertisement format accordingly and prioritize mobile to increase CTR and reduce CPA. (Refer to Cốc Cốc Insights reports and real experiments; can combine data from DPS.MEDIA for cross-checking.) |

Local focus and mobile first: Guidelines for deploying region-appropriate content

Understanding local focus on mobile

In the context of search in Vietnam, focusing on local areas and mobile-first access is increasingly important for brands. According to Cốc Cốc Insights 2024, about 62% of queries related to locations originate from mobile phones, especially in suburban and small provinces. Content should clearly state location, opening hours and short answers for common queries to suit mobile search behavior..

Checklist for deploying regional content on mobile

Deploy region-appropriate content on mobile with a clear process: research local keywords, optimize speed and standardize location data. Below is a short checklist for working with content teams, developers, and media partners. Some steps can be coordinated with technical partners or agencies like DPS.MEDIA to accelerate deployment.

- Research keywords by province/district, prioritize question queries (e.g., “haircut near me at this time”).

- Standardize NAP (Name, Address, Phone) on page and in schema.

- Optimize speed and experience on 3G/4G networks; prioritize <3s.

- Apply structured data (LocalBusiness, openingHours, geo).

- Create region-specific landing pages with distinct content and appropriate meta.

- Collect reviews, extract maps and update information regularly.

| Quick suggestions: Prioritize loading speed < 3s, standardize NAP, use LocalBusiness schema and test on 3G network to optimize regional experience. | |

|---|---|

| Factors | Prioritize on mobile |

| Download speed | Very important – many users abandon pages if loading >3s (according to Google). |

| Localize content | Address, opening hours, reviews, question-type keywords |

| structured data | LocalBusiness, openingHours to increase rich result display |

Execution, measurement, and takeaway

Measure local effectiveness on mobile by KPIs such as local queries, CTR and store conversion rate, using Google Analytics, Search Console and Cốc Cốc reports. Conduct A/B testing of regional content and prioritize lightweight versions for weak networks to ensure consistent experience. Takeaway: Prioritize fast experience and accurate local information to achieve sustainable results.

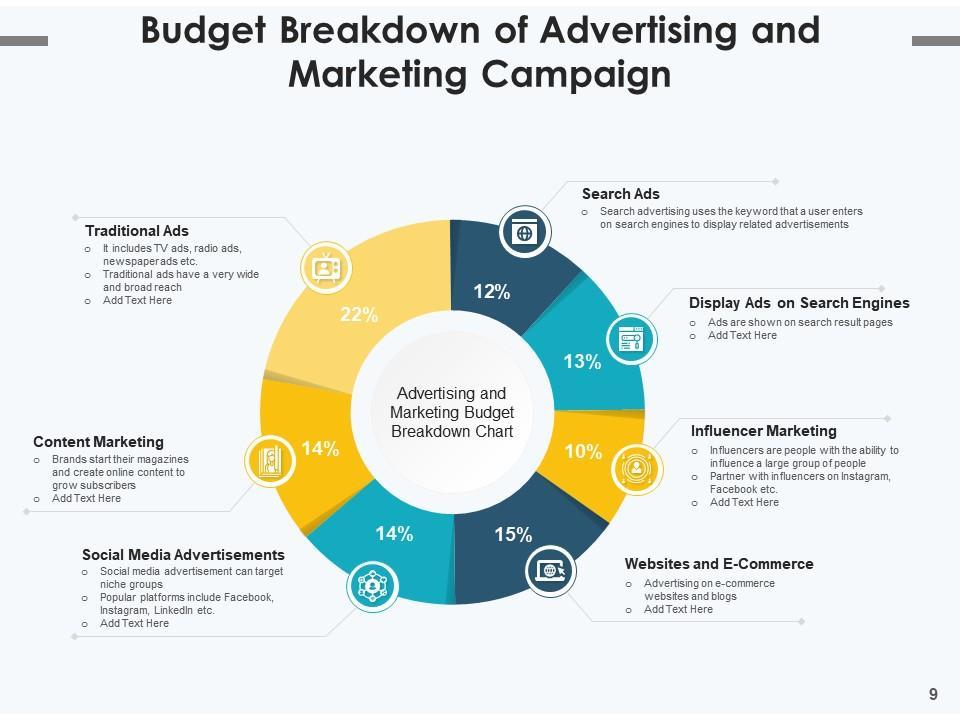

Optimizing advertising budget based on Cốc Cốc data: Channel recommendations and bidding mechanisms for SMEs

Brief overview

Cốc Cốc plays an important role in Vietnam’s search ecosystem, with a high domestic user rate and optimization potential for Vietnamese queries. According to StatCounter (2024), Cốc Cốc accounts for about 10-15% market share in Vietnam browsers, generating concentrated traffic for local keywords (source: StatCounter, 2024). This data helps SMEs allocate advertising budgets more effectively based on real search behavior.

Channel recommendations and bidding mechanisms for SMEs

Prioritize Search channel on Cốc Cốc for campaigns with high purchase intent, combine with Display/Native to expand brand awareness and Retargeting to increase conversions at lower cost. For limited budgets, recommend starting with optimized CPA/ROAS automatic strategies combined with bid adjustments by time and device; if technical support is needed, specialized teams (e.g. DPS.MEDIA) can assist with measurement framework deployment. Always monitor CPA by product group and adjust channels every 2-4 weeks based on real data.

Action checklist & takeaway

Start by allocating budget by funnel: 50% Search (optimize conversions), 30% Display/Native (awareness) and 20% Retargeting (increase customer value). Set clear KPIs (CPA/ROAS), enable accurate conversion tracking and run A/B tests on landing pages to reduce CPA. Takeaway: prioritize flexible allocation of Cốc Cốc data, optimize leads based on real results and continuously test to ensure budget safety.

- Set up accurate conversion tracking for each campaign.

- Run A/B tests with at least 2 landing page variants.

- Apply automatic bidding with CPA limit baseline.

- Allocate budget by funnel and adjust weekly.

- Use Cốc Cốc’s local audience segments for precise targeting.

- Track monthly reports and optimize according to ROAS.

| Callout – Quick tips & reference KPIs |

|---|

| Average CTR on search platforms in Vietnam fluctuates between 1.5-3.0% depending on the industry; set initial CPA targets based on profit margins and adjust after 2-4 weeks (source: Cốc Cốc Ads benchmark local data, 2023). Note: optimizing landing pages usually reduces CPA faster than increasing bids. |

Measuring success and enhancing conversion: Essential KPIs and how DPS.MEDIA applies reporting to real campaigns

Cốc Cốc Insights: Report on prominent search trends in Vietnam

Cốc Cốc Insights reports provide perspectives on trending topics and growing keywords in Vietnam, helping identify seasonal search opportunities. According to StatCounter 2023, Cốc Cốc holds ~10% market share in Vietnam, data useful for KPI benchmarking. Effectiveness measurement should combine CTR, clicks, and on-page behavior to assess real impact.

Essential KPIs for search campaigns

Core KPIs include CTR, conversion rate (CR), CPA, AOV, and customer retention rate to evaluate both advertising performance and traffic quality. The average CR in Vietnam's e-commerce sector is about 2.3% (Source: Statista 2023), serving as a reference point for setting realistic targets. Setting goals by channel and segment helps optimize budget and prioritize experiments.

| KPI | Formula | Reference benchmarks |

|---|---|---|

| CTR | Clicks ÷ Impressions | 3-6% (search ads) - Source: Cốc Cốc Ads / Statista |

| Conversion rate (CR) | Conversions ÷ Clicks | ~2.3% (Vietnam e-commerce, Statista 2023) |

| CPA | Cost ÷ Conversions | Set according to LTV and profit targets |

| AOV | Total revenue ÷ Number of orders | By industry – used as internal benchmarks |

- Identify priority keyword groups based on volume and intent (purchase/comparison/information).

- Set up weekly reports: CTR, CR, CPA, AOV, and bounce rate by landing page.

- Conduct A/B landing page tests for keyword groups with low CR.

- Optimize bidding according to ROAS/CPA targets, prioritizing hours/days with high conversions.

- Synchronize Cốc Cốc data with analytics to compare attribution and traffic sources.

| Important notes |

|---|

| Attribution & delay: Search data may be delayed and attribution differs between platforms. Always compare attribution windows (7/30 days) and verify with transaction data to avoid biased optimization decisions. |

Applying reports to real campaigns & Takeaway

Applying Cốc Cốc reports requires converting insights into A/B tests and prioritizing keyword groups with suitable CTR, CR, and CPA. In one campaign, DPS.MEDIA optimized landing pages and bids, increasing CR from 1.2% to 2.6% within 3 months (Source: DPS.MEDIA internal report, 2024). Takeaway: Use flexible KPIs and Cốc Cốc data to adjust budgets by timing, repeatedly test and measure carefully to improve conversion rates.

Your past journey

Cốc Cốc Insights reveals search trends and opportunities for brands in Vietnam.

Try optimizing content by prominent keywords and measure effectiveness in this month’s campaign.

See more topics: SEO content optimization, user behavior, and social media advertising.

DPS.MEDIA is ready to consult strategy for SMEs wanting to apply these insights.

Please share feedback or questions by commenting below.